Blockchain Insurance Market Size & Revenue by 2030

Innovations in Blockchain Technology Drive Transformation in the Insurance Sector

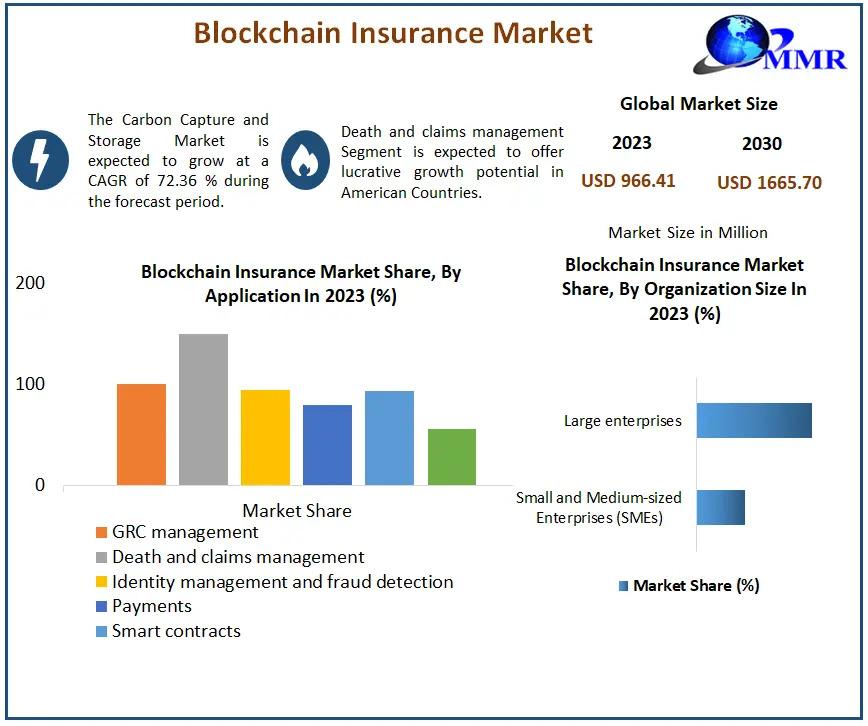

Blockchain Insurance Market Size is experiencing unprecedented growth, with projections indicating an increase from USD 1.19 billion in 2023 to approximately USD 33.5 billion by 2030. This remarkable expansion represents a compound annual growth rate (CAGR) of 61.2% during the forecast period, highlighting the transformative impact of blockchain technology on the insurance industry.

Market Estimation & Definition

Blockchain insurance refers to the application of blockchain technology—a decentralized, distributed ledger system—in the insurance sector. This technology enables secure, transparent, and tamper-proof recording of transactions and data, facilitating real-time information sharing among stakeholders. By leveraging blockchain, insurers can enhance efficiency, reduce fraud, and improve customer experiences through streamlined processes and automated claims management.

Market Growth Drivers & Opportunities

Several key factors are propelling the growth of the blockchain insurance market:

- Enhanced Transparency and Security: Blockchain's immutable ledger ensures that all transactions are recorded transparently and securely, reducing the risk of fraud and errors. This heightened level of security builds trust among policyholders and insurers alike.

FREE |Get a Copy of Sample Report Now: https://www.maximizemarketresearch.com/request-sample/11489/

- Streamlined Claims Processing with Smart Contracts: The integration of smart contracts—self-executing agreements with terms directly written into code—automates claims processing. This automation leads to faster settlements, reduced administrative costs, and increased customer satisfaction.

- Cost Reduction and Operational Efficiency: By eliminating intermediaries and automating processes, blockchain reduces operational costs for insurers. This efficiency allows for more competitive pricing and improved profitability.

- Emergence of New Insurance Models: Blockchain facilitates innovative insurance models, such as peer-to-peer insurance and parametric insurance, expanding coverage options and making insurance more accessible, especially in underserved markets.

Segmentation Analysis

The blockchain insurance market is segmented based on provider type, application, organization size, and region.

- Provider Type:

- Application and Solution Providers: These entities develop and offer blockchain-based applications tailored for insurance processes, including claims management, underwriting, and customer onboarding.

- Middleware Providers: Companies that offer intermediary services facilitating the integration of blockchain solutions with existing insurance systems.

- Infrastructure and Protocol Providers: Organizations that supply the foundational blockchain platforms and protocols upon which insurance applications are built.

For More Detailed Visit: https://www.maximizemarketresearch.com/market-report/blockchain-insurance-market/11489/

- Application:

- GRC Management: Utilizing blockchain for governance, risk, and compliance management ensures data integrity and facilitates regulatory reporting.

- Death and Claims Management: Blockchain streamlines the verification and processing of claims, reducing delays and administrative burdens.

- Payments: Secure and transparent payment processing is achieved through blockchain, enhancing transaction efficiency.

- Identity Management and Fraud Detection: Blockchain's immutable records aid in verifying identities and detecting fraudulent activities, bolstering security measures.

- Smart Contracts: The deployment of smart contracts automates policy execution and claims settlements, minimizing human intervention and errors.

- Organization Size:

- Small and Medium-Sized Enterprises (SMEs): SMEs are increasingly adopting blockchain solutions to enhance operational efficiency and remain competitive.

- Large Enterprises: Large insurance firms leverage blockchain to streamline complex processes, manage vast amounts of data, and improve customer engagement.

Regional Insights

North America currently leads the blockchain insurance market, accounting for a significant share of global revenue. This dominance is attributed to the region's advanced technological infrastructure, early adoption of blockchain solutions, and the presence of major insurance providers investing in innovative technologies.

Asia-Pacific is anticipated to exhibit the highest growth rate during the forecast period. Rapid digitalization, supportive regulatory frameworks, and increasing investments in blockchain initiatives contribute to this region's burgeoning market. Countries such as China, India, and Japan are at the forefront of integrating blockchain into their insurance sectors to enhance efficiency and expand their customer base.

Get Your Free Sample Explore the Latest Market Insights: https://www.maximizemarketresearch.com/request-sample/11489/

Competitive Landscape

The blockchain insurance market is characterized by a dynamic and competitive environment, with several key players driving innovation and adoption. Notable companies in this space include:

- IBM Corporation: A global leader in technology, IBM offers blockchain solutions that enable insurers to streamline processes and enhance data security.

- Oracle Corporation: Oracle provides a comprehensive blockchain platform that supports the development and deployment of insurance applications aimed at improving transparency and efficiency.

- Microsoft Corporation: Through its Azure Blockchain Services, Microsoft facilitates the integration of blockchain technology into insurance operations, promoting scalability and reliability.

- Amazon Web Services (AWS): AWS offers blockchain services that empower insurers to build applications for claims processing, policy management, and fraud detection.

- Guardtime: Specializing in blockchain-based cybersecurity solutions, Guardtime collaborates with insurers to implement secure and efficient data management systems.

Conclusion

The global blockchain insurance market is on a trajectory of substantial growth, driven by the technology's ability to revolutionize traditional insurance practices. As insurers continue to embrace blockchain, they are poised to achieve greater transparency, efficiency, and customer satisfaction. This transformation not only enhances operational capabilities but also paves the way for innovative insurance models that cater to the evolving needs of the market.

For additional reports on related markets, visit our website:

Gaming Hardware Market Size Outlook

Intermodal Freight Transportation Market Size Outlook

About Maximize Market Research

Maximize Market Research is a rapidly expanding market research and business consulting firm with a global client base. Our growth-oriented research strategies and focus on driving revenue impact have established us as a trusted partner to many Fortune 500 companies. With a diverse portfolio, we cater to a wide range of industries, including IT telecommunications, chemicals, food beverages, aerospace defense, healthcare, and more.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- Travels