Takaful Insurance Market: Growth Trajectory and Forecast Analysis (2024-2030)

Takaful Insurance Market: The Rise of Islamic Insurance and Its Future Prospects 2030

Market Estimation and Definition

The Takaful Insurance Market Growth is experiencing significant growth as demand for ethical and sharia-compliant financial products continues to rise across the globe. Takaful, often referred to as Islamic insurance, is based on mutual cooperation, where members contribute money into a pool that is then used to provide coverage for all participants in the event of a loss. This unique model adheres strictly to the principles of Islamic law, or Shariah, which prohibits interest, gambling, and uncertainty.

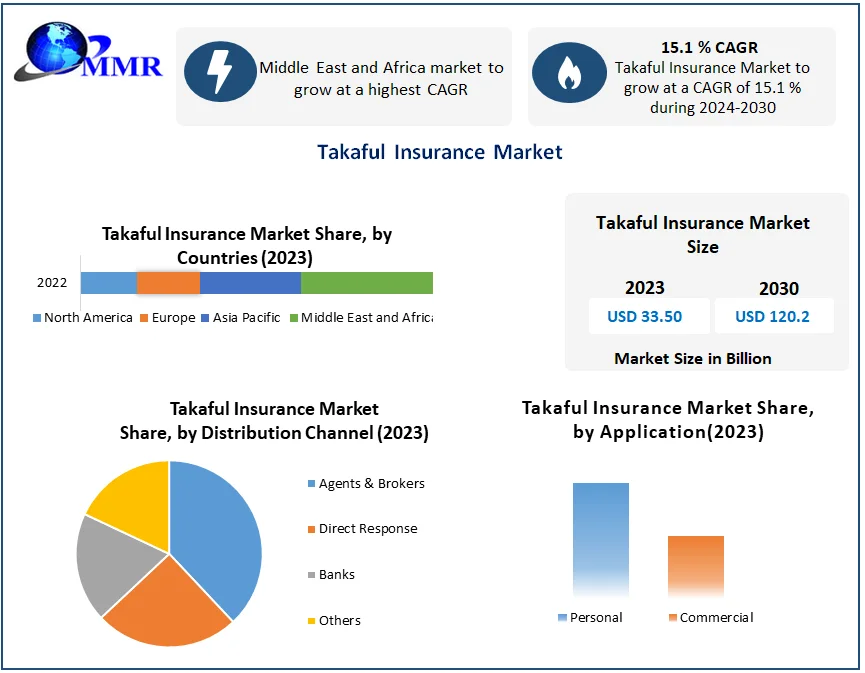

The Takaful insurance market is expected to reach USD 34.3 billion by 2027, growing at a CAGR of 15.2% from 2023 to 2027. This growth is fueled by increasing awareness of Islamic financial products, the rising number of Muslims globally, and the expanding need for ethical financial services. The Middle East and North Africa (MENA) region, home to the majority of the Muslim population, continues to dominate the market. However, markets in Southeast Asia, South Asia, and even Western nations are witnessing significant adoption.

The Takaful insurance model offers individuals a sense of security based on shared responsibility and solidarity. As the Islamic finance sector flourishes, Takaful products are increasingly becoming a viable alternative to conventional insurance models.

Curious about the market dynamics? Get a free sample to explore the latest insights here:https://www.maximizemarketresearch.com/request-sample/213737/

Market Growth Drivers and Opportunity

Several factors are driving the growth of the Takaful insurance market. The primary drivers include:

-

Increasing Muslim Population: The global Muslim population is steadily increasing, particularly in regions such as the Middle East, Southeast Asia, and South Asia. These regions are prime markets for Takaful products, as the demand for Shariah-compliant products continues to grow. In countries like Indonesia, Pakistan, and Malaysia, Takaful products have become a preferred alternative to conventional insurance, fostering a significant increase in demand.

-

Ethical Investment: There is a growing trend towards socially responsible and ethical investment options, which aligns with the principles of Takaful. Many individuals are now seeking financial products that reflect their personal values, especially in a world where ethical concerns and social consciousness are increasingly shaping purchasing decisions. Takaful insurance caters to this growing market segment by offering a transparent, ethical alternative to traditional insurance models.

-

Regulatory Support and Government Initiatives: Governments in Muslim-majority countries are actively promoting Takaful insurance through favorable regulatory frameworks and policies. For instance, in Malaysia and the UAE, governments have introduced incentives and tax breaks to encourage the growth of the Takaful sector. This regulatory support is providing a conducive environment for market expansion.

-

Technological Advancements: The integration of digital platforms and mobile applications into the Takaful insurance industry has made it easier for consumers to access and purchase these products. Insurtech is helping to streamline the application, underwriting, and claims processes, making Takaful products more accessible to a broader audience. These technological innovations are providing an opportunity for the market to expand, especially in regions where traditional insurance penetration remains low.

-

Rising Awareness: Increasing awareness about the benefits of Takaful insurance, coupled with growing access to financial literacy programs, is helping to drive market growth. As more people understand how the Takaful model works and its benefits, they are more inclined to opt for this form of insurance. Educational initiatives by financial institutions, government bodies, and insurance providers are contributing to greater market penetration.

Curious about the market dynamics? Get a free sample to explore the latest insights here:https://www.maximizemarketresearch.com/request-sample/213737/

Segmentation Analysis

The Takaful insurance market is segmented based on various criteria such as type of product, distribution channel, and geography. Each of these segments plays a critical role in shaping the market's dynamics and understanding the growth potential.

-

By Type of Takaful: The Takaful market is primarily divided into three major types:

-

Family Takaful (Life Insurance): This type of Takaful is designed to provide life insurance coverage to individuals and families. Family Takaful includes benefits such as financial support for the family in case of the policyholder’s death or incapacity, as well as health and medical coverage. This segment is expected to hold the largest share of the market due to the rising demand for life insurance and the increasing number of individuals seeking family protection and wealth accumulation.

-

General Takaful (Non-life Insurance): General Takaful covers a wide range of insurance products, including health insurance, property insurance, motor insurance, and others. This segment is growing rapidly as businesses and individuals seek protection for their assets and investments. The increasing adoption of general Takaful products in regions like the MENA and Southeast Asia is driving the segment’s expansion.

-

Retakaful: Retakaful, or reinsurance, refers to the reinsurance of Takaful companies. It is a rapidly growing segment in the Takaful industry, as it helps Takaful providers mitigate risk by transferring part of their liabilities to other insurance companies. Retakaful ensures that the Takaful providers remain financially stable, and it is gaining importance as Takaful companies expand their operations.

-

-

By Distribution Channel:

- Agency Model: This remains the traditional distribution channel for Takaful products, where agents play a pivotal role in educating customers and providing them with tailored solutions.

- Bancassurance: The bancassurance model has seen increasing adoption in recent years. This model leverages banks’ vast networks to sell Takaful products alongside their financial products, such as savings and investment accounts. This is particularly popular in markets like Malaysia, where bank branches serve as key channels for reaching customers.

- Direct Sales and Digital Channels: The rise of digital platforms has seen a significant shift toward online and mobile-based Takaful product sales. This channel provides a convenient, low-cost option for customers, especially younger and tech-savvy consumers.

-

By Geography: The Takaful market is broadly classified into the following geographical regions:

-

Middle East and North Africa (MENA): The MENA region dominates the global Takaful market, driven by countries like Saudi Arabia, the UAE, and Bahrain. These countries have well-established Takaful markets, with a growing number of players offering various products.

-

Southeast Asia: Countries like Malaysia, Indonesia, and Brunei have seen tremendous growth in Takaful insurance. These regions account for a significant share of the global market, with governments encouraging the adoption of Islamic financial products.

-

South Asia: Countries like Pakistan and Bangladesh are also contributing to the market’s expansion, with Takaful products gaining popularity as the demand for ethical and Shariah-compliant products increases.

-

Europe and North America: While still relatively nascent, the Takaful market is slowly gaining traction in non-Muslim-majority countries, including the United States, Germany, and the UK. The growing interest in Islamic finance is driving the need for Shariah-compliant insurance products in these regions.

-

To Gain More Insights into the Market Analysis, Browse Summary of the Research Report:https://www.maximizemarketresearch.com/market-report/takaful-insurance-market/213737/

Country-Level Analysis

-

USA: The USA has witnessed steady growth in demand for Takaful products, largely driven by the Muslim population's increasing awareness of Shariah-compliant financial products. While the overall market size remains small compared to traditional insurance products, there is growing interest in Takaful, particularly among younger generations. Regulatory frameworks are evolving to better accommodate Islamic finance, providing a promising environment for growth in the coming years.

-

Germany: Germany is another European market where Takaful is starting to take root. With a significant Muslim population and increasing interest in ethical investments, Takaful products are seeing greater adoption. The German insurance market has a strong regulatory framework that supports the growth of niche products like Takaful.

Commutator Analysis

The Takaful insurance market is highly fragmented, with numerous regional and international players. Leading market players include Allianz Takaful, Prudential, Dubai Islamic Insurance and Reinsurance Co. (AMAN), and Tata AIG Takaful. These companies are expanding their portfolios, introducing innovative products, and leveraging digital platforms to enhance customer engagement. Competitive strategies include partnerships with banks and digital platforms, a focus on customer service excellence, and the development of customizable, affordable Takaful products.

Conclusion

The Takaful insurance market is poised for significant growth, driven by increasing demand for Shariah-compliant financial products, technological innovations, and supportive regulatory environments. As awareness of Takaful spreads globally, more regions are expected to embrace the Islamic insurance model. The expansion of digital distribution channels, coupled with growing government support, will continue to accelerate the growth of this market. With strong growth drivers, promising opportunities, and key players adapting to evolving customer needs, the future of Takaful insurance looks incredibly bright.

More Related Reports For More Insights:

Global Inorganic Scintillators Market https://www.maximizemarketresearch.com/market-report/inorganic-scintillators-market/71538/

Low Voltage Fuse Market https://www.maximizemarketresearch.com/market-report/low-voltage-fuse-market/70499/

Global Thermo Ventilators Market https://www.maximizemarketresearch.com/market-report/global-thermo-ventilators-market/22334/

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

🌐 www.maximizemarketresearch.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- Travels