Drilling Waste Management Market Strategies, Growth, and Future Outlook 2030

Introduction

In the high-stakes world of oil and gas, efficient waste disposal is no longer just a regulatory requirement—it’s a strategic business advantage. Enter the Drilling Waste Management Market—a booming sector that’s transforming environmental responsibility into revenue potential. With increasing global drilling activities and tightening environmental regulations, the demand for sustainable, compliant, and cost-effective waste solutions has never been more urgent.

In this blog, we’ll shine a spotlight on why this market is growing rapidly, break down frequently asked questions, and explore the innovations shaping the future of drilling waste management.

Get a free sample to explore the latest insights here:https://www.maximizemarketresearch.com/request-sample/50403/

📈 Market Snapshot: Where Compliance Meets Commercial Opportunity

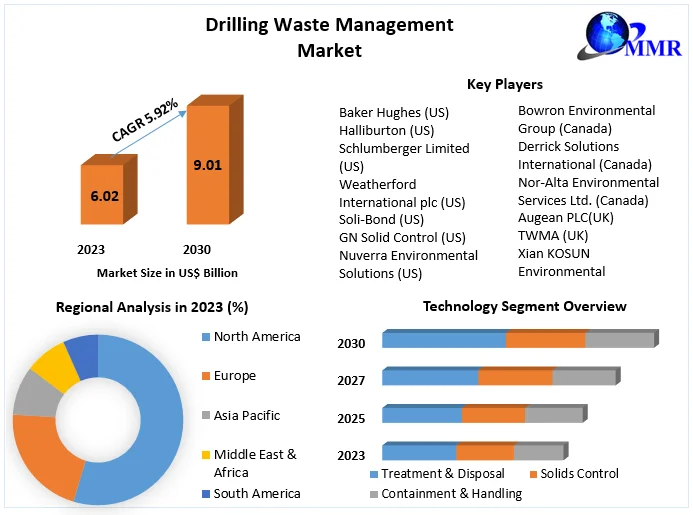

The global drilling waste management market was valued at approximately USD 5.5 billion in 2023 and is projected to reach USD 8.9 billion by 2030, growing at a CAGR of 7.1% during the forecast period. Key drivers of this growth include:

-

Stringent environmental regulations

-

Increased oil & gas exploration

-

Technological advancements in waste treatment

-

Rising environmental awareness and ESG commitments

✅ Top Market Drivers

1. Regulatory Pressure:

Governments worldwide have ramped up enforcement of drilling waste disposal standards. The U.S. Environmental Protection Agency (EPA), for example, mandates strict control on cuttings and fluids disposal—pushing companies to invest in waste treatment and recycling systems.

2. Surge in Drilling Activities:

As the world looks to balance energy demand with renewables, oil and gas exploration continues, especially in emerging markets like Africa, Latin America, and Southeast Asia. More drilling = more waste = higher demand for proper management systems.

3. Sustainable Practices in the Spotlight:

Oil majors and contractors are under pressure to align with ESG frameworks. Reducing the ecological footprint through responsible waste disposal is a powerful way to enhance brand value and secure investor trust.

4. Tech-Driven Solutions:

Advancements in solid control equipment, thermal desorption, and bioremediation have enabled more efficient, lower-cost waste processing—while also reducing environmental harm.

🤔 Frequently Asked Questions

Q1: What is drilling waste management?

Drilling waste management involves the collection, treatment, and disposal of waste generated during drilling operations—primarily drilling fluids (muds) and cuttings. The goal is to minimize environmental impact while staying compliant with local and international regulations.

Q2: What are the main types of drilling waste?

-

Drilling fluids (oil-based, water-based, synthetic)

-

Drill cuttings

-

Contaminated soil

-

Wastewater

Q3: What methods are used to treat drilling waste?

Some of the most common technologies include:

-

Thermal desorption

-

Solid control equipment (shale shakers, centrifuges)

-

Cuttings reinjection

-

Bioremediation

-

Chemical fixation

Q4: Is drilling waste hazardous?

Yes, especially when oil-based muds or synthetic fluids are used. These wastes can contain toxic hydrocarbons, heavy metals, and salts that are harmful to soil and groundwater if not properly managed.

Q5: Which sectors are investing in drilling waste management?

-

Oil & Gas Exploration Companies

-

Environmental Engineering Firms

-

Government & Regulatory Bodies

-

Drilling Contractors

To Gain More Insights into the Market Analysis, Browse Summary of the Research Report:https://www.maximizemarketresearch.com/market-report/global-drilling-waste-management-market/50403/

🌍 Regional Market Trends

| Region | Insights |

|---|---|

| North America | Dominated by the U.S. with advanced treatment technologies and strict EPA rules |

| Europe | Strong environmental mandates; Norway and the UK lead in offshore compliance |

| Asia-Pacific | Rapid expansion in India, China, and Southeast Asia drives massive market demand |

| Middle East | Growing awareness; investment in sustainable waste solutions rising steadily |

| Africa | Exploration boom fueling waste management innovation in offshore drilling |

💡 Innovations Reshaping the Market

1. Modular Treatment Systems:

These mobile waste treatment units can be deployed at remote drilling sites, reducing transportation costs and carbon emissions.

2. Zero Discharge Systems:

Tech that allows for zero-liquid discharge (ZLD) is gaining traction in offshore projects, where waste disposal is challenging.

3. Data-Driven Monitoring:

IoT and AI-powered sensors now monitor waste volume, toxicity levels, and system performance—helping companies optimize disposal methods and remain audit-ready.

4. Reuse and Recycling of Waste:

Cuttings and treated mud are now being repurposed as construction material, road base layers, or for reinjection—turning waste into value-added byproducts.

📊 Case Study: Halliburton’s Eco-Efficiency Approach

Halliburton, a global oilfield services giant, implemented a closed-loop waste management system for its Permian Basin operations. The result?

-

40% reduction in freshwater usage

-

60% recycling rate of drilling fluids

-

Increased operational uptime through on-site waste processing

This move not only reduced environmental risks but also delivered millions in cost savings, showcasing the commercial power of sustainable practices.

🔮 Future Outlook

The market is on track to expand its role in decarbonization strategies, particularly as drilling companies seek to meet net-zero goals. Expect further growth in:

-

Digital waste tracking

-

Carbon credit models for waste recycling

-

Advanced separation technologies

-

Collaborative waste-sharing platforms among oilfield operators

Companies that delay waste strategy upgrades risk regulatory penalties, reputational damage, and missed sustainability targets.

Conclusion

The Drilling Waste Management Market is no longer a backstage player—it’s a critical enabler of responsible energy production. As the oil and gas sector evolves to meet environmental, social, and governance (ESG) expectations, waste management must evolve too.

For stakeholders in energy, environmental services, and infrastructure, the time to invest in smarter, cleaner, and more efficient waste handling is now. It’s not just about cleaning up—it’s about cleaning up profitably.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jocuri

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Alte

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- Travels