Northeast and West U.S. Emerge as Hotspots for Sterilization Service Expansion

The U.S. Sterilization Services Market is witnessing a robust growth trajectory, driven by increasing awareness regarding infection prevention, stringent regulatory mandates in the healthcare industry, and the expanding medical device sector. As hospitals, clinics, pharmaceutical companies, and research laboratories intensify their focus on sterilization to ensure patient safety and product integrity, the demand for professional sterilization services is projected to surge significantly over the coming years.

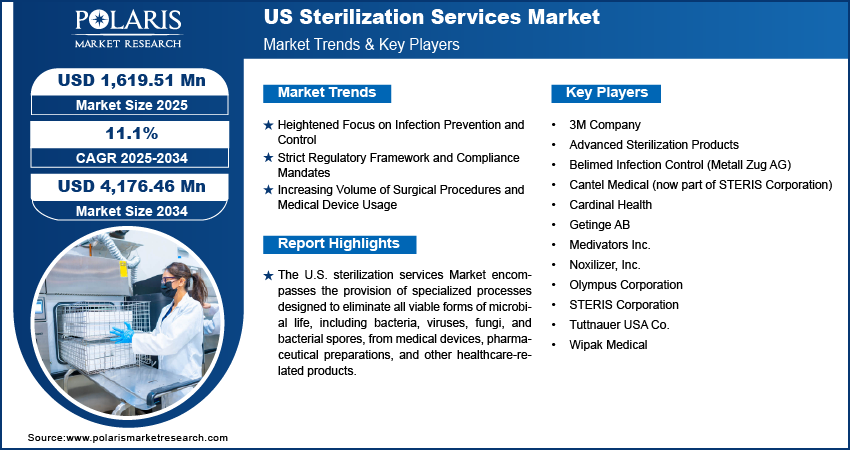

The U.S. sterilization services market size was valued at USD 1,461.00 million in 2024. The market is projected to grow from USD 1,619.51 million in 2025 to USD 4,176.46 million by 2034, exhibiting a CAGR of 11.1% during 2025–2034.

Market Overview

Sterilization services refer to the professional decontamination and sterilization of medical instruments, devices, equipment, and pharmaceuticals to eliminate microbial life and prevent the spread of infections. These services are crucial in healthcare, biotechnology, and pharmaceutical manufacturing, where maintaining aseptic environments is essential.

The U.S. sterilization services industry is increasingly benefiting from advancements in sterilization technologies such as low-temperature sterilization, ethylene oxide (EtO) sterilization, gamma irradiation, and electron beam (E-beam) sterilization. Moreover, the increased outsourcing of sterilization processes by pharmaceutical and medical device companies is contributing to market growth, allowing firms to reduce capital expenditure while ensuring regulatory compliance.

The heightened demand for contract sterilization services and growing concerns about cross-contamination in healthcare facilities continue to amplify the need for reliable, scalable sterilization solutions across various verticals.

Market Segmentation

The U.S. sterilization services market is segmented based on method, end-user, and service type, offering diverse options to cater to various industrial and healthcare demands.

By Method:

- Ethylene Oxide (EtO) Sterilization

- Widely used for temperature-sensitive devices.

- Known for its effectiveness in penetrating complex devices and materials.

- Preferred for high-volume, disposable medical products.

- Offers rapid turnaround and deep material penetration.

- Ideal for instruments that can withstand high temperatures and moisture.

- Common in hospital and laboratory settings.

- Provides faster processing time.

- Eco-friendly and increasingly adopted for food packaging and medical equipment.

- Includes hydrogen peroxide gas plasma and dry heat methods.

By End-User:

- Hospitals & Clinics

- Pharmaceutical Companies

- Medical Device Manufacturers

- Food & Beverage Industry

- Biotechnology Firms

- Research Laboratories

Hospitals and medical device manufacturers constitute the largest share due to the extensive need for sterile tools and equipment during surgeries and treatments. However, the pharmaceutical sector is rapidly adopting sterilization services to ensure product quality and regulatory compliance.

By Service Type:

- Contract Sterilization Services

- Validation Services

- Sterility Assurance and Testing

- Advisory & Regulatory Compliance Services

Contract sterilization services dominate the market, with medical device and pharmaceutical firms outsourcing to third-party providers for cost-efficiency, faster turnaround times, and compliance with FDA and CDC regulations.

Regional Analysis

The United States remains the dominant market for sterilization services in North America, owing to its advanced healthcare infrastructure, extensive R&D activities, and strict government regulations.

Key Highlights by Region:

- Northeast U.S. (New York, Massachusetts, Pennsylvania):

A hub for biotechnology and pharmaceutical companies, with high demand for sterilization validation services. - Midwest (Illinois, Ohio, Michigan):

Strong presence of contract sterilization service providers and medical device manufacturing facilities. - South (Texas, Florida, Georgia):

Increasing number of ambulatory surgical centers (ASCs) and rising awareness of infection prevention protocols. - West (California, Washington, Arizona):

A center for technological innovation in sterilization methods and home to several leading sterilization service companies.

The presence of federal agencies such as the FDA and CDC also reinforces the regulatory landscape in the U.S., further bolstering the market's focus on high-quality sterilization procedures.

Read More @ https://www.polarismarketresearch.com/industry-analysis/us-sterilization-services-market

Key Companies

The U.S. sterilization services market is highly competitive, with a mix of multinational corporations and specialized service providers focusing on technology development, capacity expansion, and strategic partnerships.

Leading Players:

- STERIS plc

- One of the largest players, offering a wide range of sterilization and decontamination services including EtO, gamma, and steam sterilization.

- Offers contract sterilization and lab testing services across a broad spectrum of industries, including medical and food.

- Specializes in infection prevention and sterilization systems for endoscopy and dental markets.

- Provides sterilization assurance, monitoring, and validation products and services.

- A Johnson & Johnson spin-off, ASP focuses on low-temperature hydrogen peroxide sterilization technologies.

- A major provider of electron beam sterilization services for medical, pharmaceutical, and consumer products.

- Offers turnkey sterilization and validation solutions to medical device firms looking for efficient, scalable services.

These companies are continuously investing in R&D to develop more efficient, eco-friendly, and automated sterilization technologies. Moreover, strategic mergers and acquisitions are being pursued to expand service capabilities and geographic presence.

Trends and Opportunities

Several market trends are shaping the future of sterilization services in the U.S.:

- Rise in Single-Use Medical Devices:

Growing adoption of disposable instruments is increasing the need for high-throughput sterilization. - Sustainable Sterilization Solutions:

Demand for greener, low-emission methods is encouraging innovations in hydrogen peroxide and E-beam technologies. - Digital Sterilization Monitoring:

Integration of IoT and AI for real-time monitoring and tracking of sterilization cycles ensures accuracy and compliance. - Customized Sterilization Protocols:

Tailored solutions for complex device designs and sensitive pharmaceuticals are gaining traction. - COVID-19 Aftermath:

Pandemic-led emphasis on hygiene has established long-term practices across industries, increasing demand beyond healthcare.

Conclusion

With the ever-growing emphasis on infection control, compliance with federal health and safety standards, and the increasing outsourcing of sterilization services, the U.S. sterilization services market is well-positioned for sustainable growth.

Players who invest in innovative sterilization techniques, strengthen service offerings, and prioritize regulatory alignment are expected to lead the market forward.

More Trending Latest Reports By Polaris Market Research:

Reclaimed Rubber from Devulcanization Market

Revolutionizing Citizen Services: The Growing AI Market

Digital Transaction Management

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- Travels