Passenger Vehicle Segment Fuels Demand in E-Commerce Automotive Aftermarket Landscape

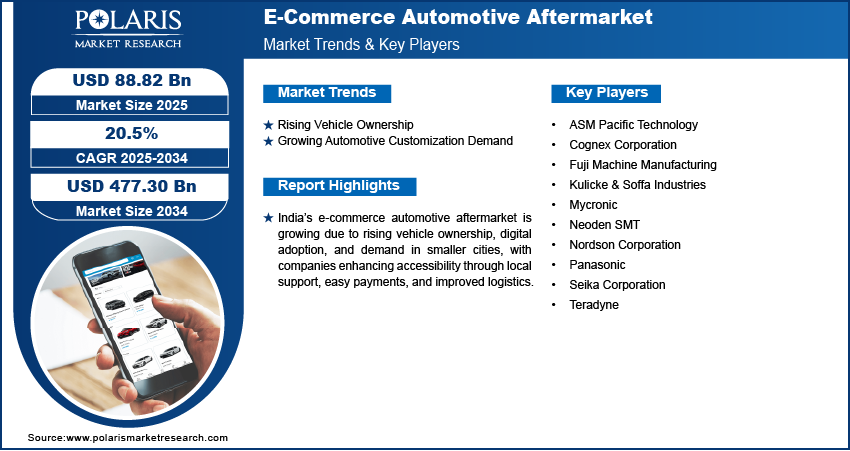

The global e-commerce automotive aftermarket size was valued at USD 73.98 billion in 2024. It is projected to grow from USD 88.82 billion in 2025 to USD 477.30 billion by 2034, exhibiting a CAGR of 20.5% during 2025–2034.

Market Overview

The e-commerce automotive aftermarket refers to the online sale of replacement parts, tools, and accessories used for vehicle maintenance and repair after the original sale. This includes mechanical parts, electrical components, performance parts, and a wide array of interior and exterior accessories. The sector has gained immense traction over the past decade due to digital advancements and a paradigm shift in consumer behavior toward online purchases.

Consumers are increasingly turning to online platforms for aftermarket auto components because of competitive pricing, product variety, ease of comparison, and direct-to-door delivery. Moreover, the rise in older vehicles on the road, coupled with an increased awareness of preventative maintenance, is driving demand for vehicle repair parts online.

According to recent market estimates, the global e-commerce automotive aftermarket is expected to reach significant revenue milestones by 2030, growing at a compound annual growth rate (CAGR) exceeding 12%. This surge is supported by the growing prominence of mobile commerce (m-commerce), smart logistics systems, and the integration of AI-powered tools for predictive maintenance and real-time inventory management.

Market Segmentation

The market is broadly segmented by component type, consumer type, vehicle type, and channel.

By Component Type

- Engine Components

- Suspension & Brake Parts

- Electrical Products

- Tires & Wheels

- Interior Accessories

- Exterior Accessories

- Lighting Systems

Suspension and brake parts currently dominate market share, followed closely by engine components, owing to wear-and-tear frequency and recurring maintenance needs. Interior accessories, such as floor mats, infotainment systems, and steering wheel covers, are also seeing growing popularity, especially in DIY markets.

By Consumer Type

- DIY (Do-It-Yourself)

- DIFM (Do-It-For-Me)

The DIY segment is witnessing rapid growth, especially among younger, tech-savvy consumers seeking affordable alternatives to dealership services. Tutorials, online communities, and customer reviews empower buyers to select and install aftermarket auto components independently.

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Two-Wheelers

Passenger vehicles dominate e-commerce aftermarket sales due to their global prevalence and higher frequency of maintenance. However, two-wheelers are also gaining momentum in emerging economies where motorbike ownership is high and parts accessibility remains a challenge offline.

By Channel

- Third-Party Retailers (e.g., Amazon, eBay, Alibaba)

- Direct-to-Consumer (OEM or Brand Websites)

While third-party platforms hold a significant market share due to reach and scale, many OEMs and aftermarket brands are investing in direct-to-consumer (DTC) e-commerce strategies to improve margins and build customer loyalty.

Regional Analysis

The growth trajectory of the online auto parts market is global, but regional trends reveal unique patterns based on infrastructure, consumer behavior, and regulatory frameworks.

Read More @ https://www.polarismarketresearch.com/industry-analysis/e-commerce-automotive-aftermarket

North America

North America, particularly the United States, remains a global leader in the e-commerce automotive aftermarket. The region is home to high internet penetration, a strong DIY culture, and aging vehicle fleets. Additionally, the proliferation of e-commerce platforms, free shipping policies, and same-day delivery services have significantly boosted consumer confidence in buying automotive parts online.

Europe

Europe is seeing accelerated growth driven by environmental regulations, electrification of vehicles, and rising consumer awareness around preventive maintenance. Countries like Germany, the UK, and France are leading markets, with numerous auto part brands strengthening their digital presence. The EU's push toward sustainability is also influencing the sales of green and remanufactured auto parts.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with China and India at the forefront. These markets benefit from a high volume of vehicles, increasing smartphone penetration, and a rising middle class inclined toward digital shopping. In China, e-commerce giants like Alibaba and JD.com are heavily invested in the digital automotive aftermarket, integrating AI and logistics automation to enhance customer experience.

Latin America

Latin America, led by Brazil and Mexico, is witnessing steady market expansion driven by improving internet infrastructure and growing automotive ownership. Local retailers and global e-commerce players are beginning to invest more aggressively in logistics and supply chain networks to tap into underserved regions.

Middle East & Africa

While still in the early adoption phase, markets across the Middle East and Africa show promise. The growing population of used vehicles, coupled with increasing internet adoption, presents an opportunity for long-term e-commerce aftermarket growth.

Key Companies in the Market

The competitive landscape of the E-Commerce Automotive Aftermarket is characterized by a mix of e-commerce giants, traditional auto part distributors, tech-driven startups, and OEM-backed platforms. These players compete on price, product variety, delivery speed, and customer service. Leading companies are investing heavily in technology integration—such as AR for virtual part fitting, AI-driven recommendation engines, and blockchain for inventory traceability.

Some key companies contributing to the market's growth include:

- Amazon.com, Inc. – One of the largest online marketplaces globally, offering an extensive range of automotive parts and tools with fast delivery options.

- eBay Inc. – Known for its vast reseller network and used parts ecosystem, especially in North America and Europe.

- Alibaba Group – A dominant force in Asia-Pacific, facilitating B2B and B2C transactions across the automotive supply chain.

- Advance Auto Parts, Inc. – Leveraging its physical footprint and online platform to cater to DIY and DIFM consumers.

- AutoZone, Inc. – Combining in-store expertise with e-commerce convenience for a hybrid customer experience.

- CarParts.com, Inc. – A dedicated online platform with a growing footprint in North America, focusing on fast shipping and robust inventory.

These companies are integrating advanced logistics, partnering with last-mile delivery providers, and improving mobile app functionality to gain competitive advantage.

Future Outlook

The global e-commerce automotive aftermarket is poised to reshape how consumers interact with automotive maintenance and parts purchasing. As customer expectations for speed, transparency, and product availability continue to rise, digital transformation will remain central to market success.

The convergence of automotive IoT, predictive maintenance, and e-commerce platforms is expected to create a more personalized and data-driven experience. As automakers and aftermarket players shift toward digital ecosystems, partnerships between logistics providers, parts manufacturers, and technology firms will become increasingly critical.

Conclusion

The e-commerce automotive aftermarket is no longer a niche—it is a rapidly expanding global industry fueled by digitalization, consumer empowerment, and strategic innovation. As the demand for convenient, cost-effective, and wide-ranging vehicle repair parts online continues to grow, companies that embrace omnichannel strategies and invest in seamless digital experiences will lead the next decade of automotive retail evolution.

More Trending Latest Reports By Polaris Market Research:

All-Terrain Vehicle (ATV) and Utility Task Vehicle (UTV) Market

Material Handling Equipment Market

Professional Service Automation Market

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- Travels