North America and Europe See Surge in Demand for Advanced Speed Sensing Technologies

The global Speed Sensor Market is witnessing a transformative surge, driven by the rapid adoption of digital technologies in automotive systems, industrial automation, and consumer electronics. These sensors, essential for measuring rotational and linear speed, have become integral to safety, control, and efficiency in modern machinery and vehicles. With increasing investments in smart mobility, robotics, and factory automation, the global market for speed sensors is expected to witness sustained growth over the next decade.

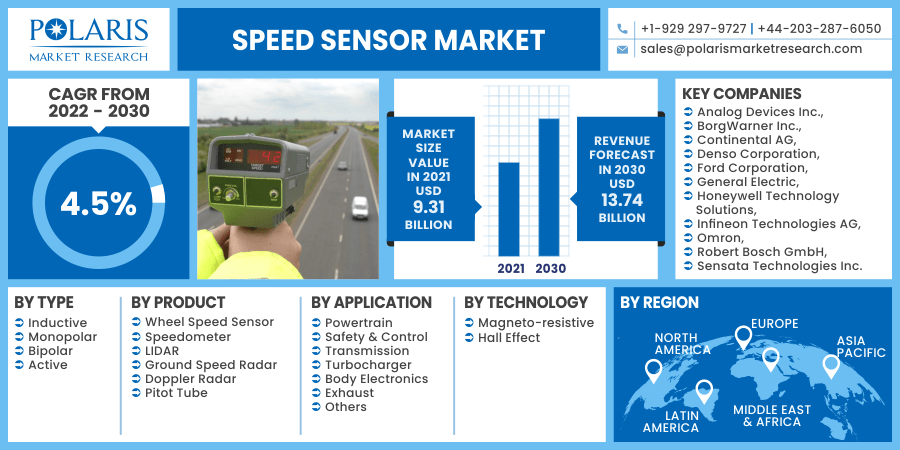

The global speed sensor market was valued at USD 9.31 billion in 2021 and is expected to grow at a CAGR of 4.5% during the forecast period.

Market Overview

Speed sensors are devices that detect the speed of an object and convert it into readable signals for monitoring or control. They are widely used in automotive systems for transmission control, engine management, and anti-lock braking systems (ABS), as well as in industrial machines for conveyor speed regulation, motor control, and predictive maintenance.

The transition toward electrification in vehicles and the rise of Industry 4.0 initiatives are reshaping the demand landscape. Magnetic speed sensors, which are robust and highly accurate in harsh environments, are gaining significant traction across heavy industries and vehicle manufacturing. Additionally, the increased emphasis on safety and regulatory compliance in transportation systems is fostering the integration of more precise rotational speed sensors.

Market Segmentation

The Speed Sensor Market is segmented into various categories based on type, technology, application, and end-user industry, providing a comprehensive view of its evolving dynamics.

1. By Type:

- Rotational Speed Sensors: Widely used in automobiles, industrial motors, and turbines to measure shaft and wheel rotations. Their accuracy and durability in dynamic conditions make them indispensable in critical systems.

- Linear Speed Sensors: Used for measuring straight-line movement, often applied in robotics, elevators, and linear actuators.

- Angular Speed Sensors: Primarily adopted in motion control and aerospace applications to monitor angular velocity.

2. By Technology:

- Magnetic Speed Sensors: Operate on the principle of detecting changes in magnetic fields and are ideal for rugged industrial environments.

- Optical Speed Sensors: Offer high precision by detecting light interruptions; commonly used in laboratories and low-dust settings.

- Hall Effect Sensors: Utilize the Hall effect to detect magnetic fields and are used for contactless and accurate speed detection.

- Eddy Current Sensors: Typically used in high-speed and high-temperature applications, such as turbines and compressors.

3. By Application:

- Automotive: The largest application segment, encompassing vehicle speed monitoring, engine and transmission management, ABS, and electric vehicle powertrains.

- Industrial Automation: Speed sensors help monitor and regulate machinery, reducing downtime and enabling predictive maintenance in factories.

- Consumer Electronics: Includes smart appliances and gaming consoles where motion and speed control are necessary.

- Aerospace and Defense: Used in navigation, propulsion, and stability systems for aircraft and defense equipment.

4. By End-User:

- Automotive OEMs

- Industrial Equipment Manufacturers

- Aerospace Companies

- Electronics Manufacturers

- Energy & Utility Providers

Regional Analysis

The Speed Sensor Market spans major global regions, with each contributing uniquely based on its industrial capabilities, technological adoption, and regulatory landscape.

1. North America

North America remains a dominant market, especially the United States, driven by high automotive production, strong industrial automation infrastructure, and advanced aerospace programs. The region's early adoption of electric vehicles and integration of IoT in manufacturing provides a fertile environment for sensor innovations.

2. Europe

Europe holds a significant market share due to its established automotive industry, particularly in Germany, France, and Italy. The region’s strict automotive safety regulations and investments in Industry 4.0 technologies have accelerated the demand for advanced speed sensors. Magnetic and Hall-effect sensors are widely used in both automotive and renewable energy applications here.

3. Asia-Pacific

Asia-Pacific is expected to witness the fastest growth during the forecast period, led by China, Japan, South Korea, and India. The region's rapid urbanization, growing middle-class population, and increasing demand for smart vehicles contribute significantly to market expansion. Additionally, the rise in industrial automation in manufacturing hubs like China and India is fueling demand for durable and efficient speed sensors.

4. Latin America and Middle East & Africa (LAMEA)

Although still emerging, these regions present opportunities due to increasing infrastructure development, automotive assembly plants, and government efforts to modernize industrial sectors. Latin America's rising consumer electronics demand and Africa’s infrastructure projects are supporting the market at a steady pace.

Read More @ https://www.polarismarketresearch.com/industry-analysis/speed-sensor-market

Key Companies

The global Speed Sensor Market is moderately fragmented, featuring a mix of multinational giants and innovative regional players. Key strategies include mergers, R&D investments, product launches, and expansion into emerging markets.

1. Robert Bosch GmbH

A leader in automotive and industrial sensors, Bosch offers a wide array of rotational speed sensors and Hall-effect devices known for their precision and durability. The company invests heavily in autonomous mobility and electrification.

2. Honeywell International Inc.

Honeywell produces high-performance magnetic speed sensors for industrial and aerospace applications. Their solutions support heavy-duty performance in extreme conditions, making them suitable for mining and aviation.

3. Continental AG

Continental focuses on automotive electronics, supplying vehicle manufacturers with sensors for ABS, transmission control, and engine management. Their vehicle speed monitoring technologies are critical for ADAS and EV systems.

4. Infineon Technologies AG

Infineon is a prominent supplier of semiconductor-based sensors, including Hall-effect and angle sensors, used in both automotive and consumer devices. The company leverages cutting-edge chip technology to improve speed measurement accuracy.

5. TE Connectivity

TE Connectivity provides robust and scalable speed sensor solutions tailored for high-performance industrial equipment. Their sensors are widely adopted in process automation and heavy machinery.

6. Other Notable Players:

- Allegro Microsystems

- ZF Friedrichshafen AG

- Denso Corporation

- NXP Semiconductors

- Melexis NV

These companies are expanding their product portfolios through innovation in sensor miniaturization, wireless communication integration, and AI-enhanced predictive analytics.

Market Drivers

- Growth in Electric and Autonomous Vehicles: Demand for real-time vehicle speed monitoring systems has increased due to enhanced safety and autonomous navigation requirements.

- Rise in Industrial Automation: As industries move toward digital manufacturing, speed sensors are essential in maintaining operational efficiency and reducing equipment failures.

- Stringent Safety Regulations: Regulatory mandates on vehicle safety and industrial machine performance are compelling companies to invest in reliable sensor systems.

- Technological Advancements: Developments in MEMS (micro-electromechanical systems) and wireless sensors are enabling compact, energy-efficient, and high-precision solutions.

- Smart Cities and Infrastructure Projects: These initiatives rely on sensor-integrated systems for monitoring traffic, railways, and energy infrastructure.

Challenges

- Price Sensitivity in Emerging Markets: Despite high demand, budget constraints in developing economies may limit adoption of advanced sensor technologies.

- Technical Complexity: Integration of sensors with IoT platforms and maintaining calibration accuracy can be challenging.

- Supply Chain Disruptions: Global chip shortages and geopolitical uncertainties may hamper production and supply consistency.

Future Outlook

The future of the Speed Sensor Market is increasingly tied to digital transformation trends across mobility and industry. As 5G connectivity, AI, and edge computing penetrate sensor ecosystems, speed sensors will play a critical role in autonomous systems, smart transportation, and next-gen manufacturing.

More Trending Latest Reports By Polaris Market Research:

Point-of-Sale (POS) Terminals Market

Retail Point-Of-Sale (POS) Terminals Market

Mobile Point-of-Sale (mPOS) Terminals Market

Battery Management System Market

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- Travels