Investment Banking Market Size, Share and Trends | Growth [2032]

Investment Banking Market Overview:

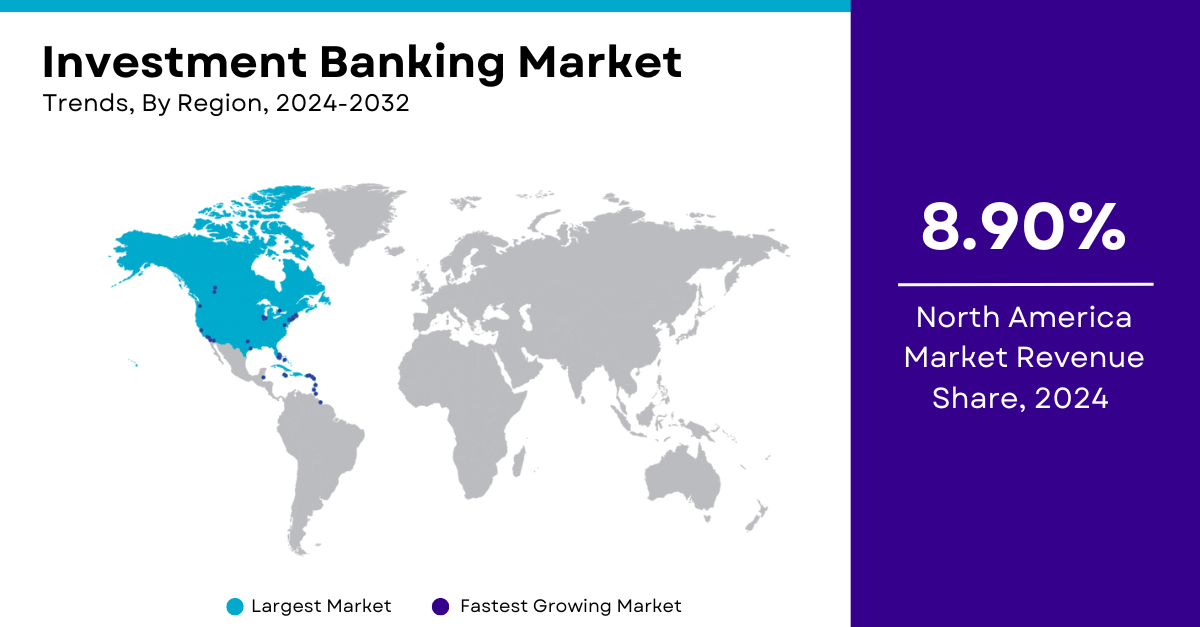

The investment banking market, an integral component of the global financial system, focuses on providing services such as underwriting, mergers and acquisitions (M&A) advisory, and trading of securities. Investment banks play a crucial role in the capital formation process for companies, governments, and other entities. This market has evolved significantly, driven by technological advancements, regulatory changes, and shifting economic conditions. In recent years, the market has experienced robust growth, fueled by increasing capital market activities and the expansion of emerging economies. The Investment Banking market size is projected to grow from USD 169.8 Billion in 2023 to USD 335.8 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 8.90% during the forecast period (2023 - 2032).

Get a sample PDF of the report at –

https://www.marketresearchfuture.com/sample_request/11815

Competitive Analysis:

The investment banking sector is characterized by a highly competitive landscape dominated by a few major players. Key firms in this market include,

- JPMorgan Chase & Co.

- Goldman Sachs Group Inc.

- Morgan Stanley

- Bank of America Merrill Lynch

- Citigroup Inc.

These institutions possess significant market share due to their extensive global presence, diversified service offerings, and substantial financial resources. In addition to these giants, boutique investment banks and regional players also hold a notable market position by offering specialized services or catering to specific geographical areas. The competition is intense, with firms continuously striving to enhance their technological capabilities, expand their service portfolios, and improve client relationships to gain a competitive edge.

Market Drivers:

Several factors drive the growth of the investment banking market. Firstly, the increasing complexity of financial markets and the need for sophisticated financial solutions drive demand for investment banking services. Companies seeking capital for expansion, mergers, or acquisitions require expert advisory and underwriting services, which investment banks provide. Secondly, the rise of technological innovations, such as artificial intelligence (AI) and big data analytics, has transformed investment banking operations, enabling more efficient and accurate financial analysis and decision-making. Additionally, the globalization of financial markets has opened new opportunities for investment banks to expand their services and client base across borders. The growing trend of digitalization in financial services and the increasing need for strategic financial planning further contribute to the market's expansion.

Market Restraints:

Despite its growth, the investment banking market faces several challenges. Regulatory constraints are one of the primary restraints, as stringent compliance requirements and evolving regulations impact operational efficiency and profitability. Investment banks must navigate complex legal frameworks and ensure adherence to regulations such as the Dodd-Frank Act and Basel III, which can be costly and time-consuming. Additionally, market volatility and economic uncertainties pose risks to investment banking activities, affecting deal flow and investor confidence. The high cost of technology investment and cybersecurity threats also represent significant challenges, as firms must continuously update their systems and safeguard sensitive financial information against cyber-attacks.

Segment Analysis:

The investment banking market is segmented based on service offerings, client types, and geographical regions. Key service segments include underwriting, M&A advisory, trading and sales, and asset management. Underwriting services involve raising capital for companies through the issuance of securities, while M&A advisory services assist firms in navigating complex mergers and acquisitions. Trading and sales encompass activities related to buying and selling securities, while asset management focuses on managing investment portfolios for clients.

Client types in the investment banking market are broadly categorized into corporate clients, institutional investors, and government entities. Corporate clients seek investment banking services for capital raising, mergers, and strategic financial planning. Institutional investors, including pension funds and mutual funds, rely on investment banks for trading and investment management services. Government entities engage investment banks for public offerings and advisory services related to economic development projects.

Browse a Full Report –

https://www.marketresearchfuture.com/reports/investment-banking-market-11815

Regional Analysis:

Geographically, the investment banking market is analyzed across key regions, including North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa (MEA). North America, particularly the United States, remains a dominant region due to its well-established financial markets, extensive banking infrastructure, and high concentration of leading investment banks. The European market, with major financial hubs in London and Frankfurt, also contributes significantly to the global investment banking landscape.

In the Asia-Pacific region, emerging economies such as China and India are witnessing rapid growth in investment banking activities, driven by economic expansion and increasing corporate investments. Latin America and the MEA regions are experiencing gradual growth, supported by economic development projects and increasing foreign investments. However, regional disparities in regulatory environments and economic conditions can influence market dynamics and growth prospects.

The investment banking market continues to evolve, driven by technological advancements, globalization, and increasing demand for sophisticated financial solutions. While the market presents significant growth opportunities, it also faces challenges related to regulatory compliance, market volatility, and technological investments. Understanding the competitive landscape, market drivers, and regional dynamics is essential for stakeholders seeking to navigate this complex and dynamic sector. As investment banks adapt to changing market conditions and technological innovations, they are likely to play an increasingly pivotal role in shaping the global financial landscape.

Top Trending Reports:

Interactive Voice Response Market

Contact

Market Research Future (Part of Wantstats Research and Media Private Limited)

99 Hudson Street, 5Th Floor

New York, NY 10013

United States of America

+1 628 258 0071 (US)

+44 2035 002 764 (UK)

Email: sales@marketresearchfuture.com

Website: https://www.marketresearchfuture.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- Travels