India Lead Acid Battery Market: Sectors Like Telecom and Auto Boosting Growth

India lead acid battery market is driven by rising demand for continuous power supply across sectors like datacenters, telecom, and automobile, boosting growth nationwide.

According to the TechSci Research report, “India Lead Acid Battery Market – By Region, Competition, Forecast and Opportunities, 2030,” several factors are contributing to the market's growth in the upcoming years. India lead Acid Battery Market was valued at USD 4,495.40 million in 2023 and is anticipated to project robust growth in the forecast period with a CAGR of 6.80%. A significant driver is the increasing demand for continuous power supply from industries such as telecom and automotive. The government’s focus on boosting the manufacturing of electric vehicles, including electric two-wheelers, is also playing a key role. Moreover, the demand for data centers in India has surged over the past five years, with lead acid batteries being widely used for power backup. These factors are expected to continue driving the growth of the India lead acid battery market during the forecast period.

The involvement of automobile manufacturers is also having a significant impact on the lead acid battery market in India. Manufacturers have recognized the potential of the Indian market and are heavily investing in research and development to produce more efficient and affordable vehicles. The rise in automotive sales after the COVID-19 pandemic has further promoted the market for lead acid batteries, as they are reliable, cost-effective, and widely used in vehicles. Additionally, the shift from old internal combustion engine (ICE) two-wheelers to electric scooters has been accelerating. This transition, fueled by environmental concerns, government initiatives, and evolving consumer preferences, is leading to a surge in demand for lead acid batteries.

Furthermore, the Indian government has launched several initiatives to provide affordable housing for residents. Programs like the Pradhan Mantri Awas Yojana (PMAY), Credit Linked Subsidy Scheme (CLSS), and Affordable Rental Housing Complexes (ARHC) are aimed at increasing access to housing, especially for the urban poor and migrant workers. As these initiatives expand, the demand for electricity is expected to rise, further driving the need for lead acid batteries in the coming years.

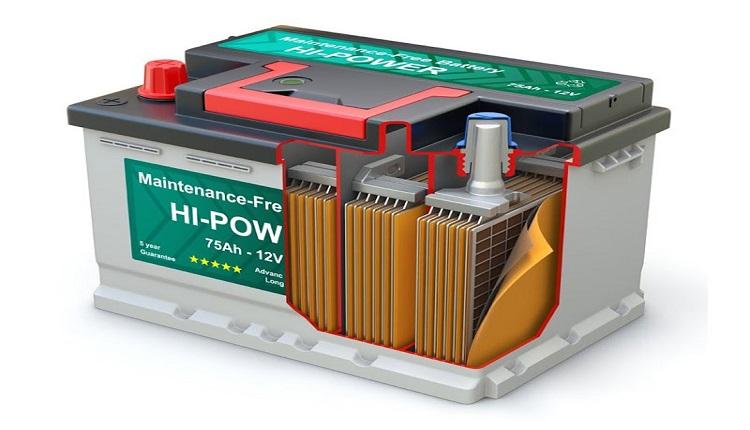

The India lead acid battery market is segmented by product type, construction method, technology, application, and region. The product types include SLI (Starting, Lighting, Ignition), stationary, and motive. The market is also categorized by construction method, with flooded and VRLA (Valve-Regulated Lead-Acid) batteries being the main types. In terms of technology, the market is divided into basic and advanced lead acid batteries. The applications of lead acid batteries include transportation, industrial, commercial, residential, and others. Additionally, the market is analyzed by region, covering North, South, West, and East India.

The SLI (Starting, Lighting, Ignition) segment currently dominates the India lead acid battery market, holding a 51.03% share in 2023. This dominance is expected to continue due to the ongoing expansion of the automotive industry in India. The entry of major manufacturers like Camel, one of Asia’s largest SLI battery producers, into the Indian market is expected to increase the production of SLI batteries, driving further growth in the segment.

Browse over XX market data Figures spread through XX Pages and an in-depth TOC on the "India Lead Acid Battery Market."

https://www.techsciresearch.com/report/india-lead-acid-battery-market/3061.html

In terms of application, the transportation sector leads the market, with a value of USD 2,277.54 million and a 50.66% share in 2023. It is projected to reach USD 3,195.76 million by the end of 2030, growing at a CAGR of 6.08% during the period from 2024 to 2030. The transportation application is expected to maintain its dominance, accounting for 48.67% of the market share by 2030. Government policies and incentives for electric vehicle adoption, including subsidies and tax benefits, are likely to further fuel demand for lead acid batteries in the transportation sector.

Key market players in the India lead acid battery market include:

- Exide Industries Limited

- Amara Raja Batteries Limited

- Luminous Power Technologies Pvt. Ltd

- Okaya Power Private Limited

- HBL Power Systems Limited

- Jayachandran Industries Private Limited

- Leoch Batteries India Pvt Ltd

- Livguard energy technologies Pvt Ltd

- Tata AutoComp GY Batteries Private Limited

- Microtex Energy Private Limited

Download Free Sample Report

https://www.techsciresearch.com/sample-report.aspx?cid=3061

Customers can also request 10% free customization on this report.

“India lead acid battery market is expected to register a high CAGR owing to rising populations and urbanization, increasing demand of power supply, government focuses on rising usage of electric vehicles (EVs), and others. The Indian government has played a pivotal role in nurturing the lead acid battery industry. Policies such as Make in India, Atmanirbhar Bharat (self-reliant India), and the National Electric Mobility Mission Plan have provided impetus to the sector. National Smart Grid Mission and few small grid pilot projects play an important role for battery installation in various applications such as load balancing, ancillary services, and grid storage. Thus, it creates a significant demand for lead-acid batteries in India.

Additionally, the increase in data centers and tower installations during the forecast period is likely to drive the demand for lead-acid batteries across the country. Therefore, the market for lead acid battery across the country is expected to rise in the forecast period, 2025-2029F.” said Mr Karan Chechi, Research Director with TechSci Research, a research-based global management consulting firm.

“India Lead Acid Battery Market By Product Type (SLI, Stationary, and Motive), By Construction Method (Flooded, VLRA), By Technology (Basic, Advanced Lead Acid), By Application (Transportation, Industrial, Commercial, Residential, and Others), By Region, Competition, Forecast and Opportunities, 2029F”, has evaluated the future growth potential of an India lead acid battery market and provides statistics and information on market structure, size, share, and future growth. The report intends to provide cutting-edge market intelligence and help decision makers take sound investment decisions. Besides, the report also identifies and analyzes the emerging trends along with essential drivers, challenges and opportunities in the India lead acid battery market.

Contact

Techsci Research LLC

420 Lexington Avenue,

Suite 300, New York,

United States- 10170

Tel: +13322586602

Email: sales@techsciresearch.com

Website: https://www.techsciresearch.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- Travels