Green Ammonia Market Analysis (2024-2030): Decarbonizing the Future

1. Market Estimation & Definition

The Green Ammonia Market is poised for significant growth over the coming years, driven by the global shift towards sustainable energy solutions and decarbonization. Green ammonia, produced using renewable energy sources such as wind, solar, or hydropower, is emerging as a key player in the transition to a low-carbon economy. Unlike conventional ammonia, which is produced using fossil fuels and contributes significantly to greenhouse gas emissions, green ammonia is manufactured through electrolysis of water using renewable electricity, followed by the Haber-Bosch process to synthesize ammonia. This process eliminates carbon emissions, making green ammonia a sustainable alternative for various applications, including fertilizers, energy storage, and transportation fuel.

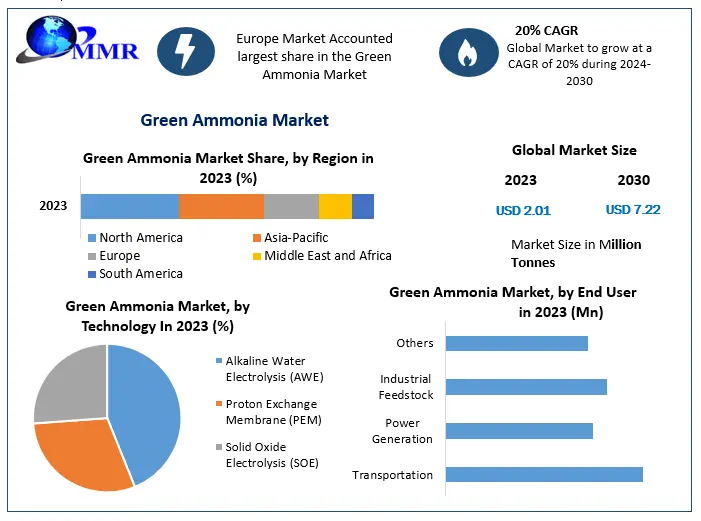

The global green ammonia market was valued at approximately USD 30 million in 2022 and is projected to grow at a compound annual growth rate (CAGR) of over 70% from 2023 to 2030. By 2030, the market is expected to reach a valuation of USD 5.4 billion, driven by increasing investments in renewable energy infrastructure, government policies supporting green hydrogen and ammonia production, and the growing demand for carbon-free fertilizers and fuels.

2. Market Growth Drivers & Opportunities

The green ammonia market is being propelled by several key factors:

-

Decarbonization Initiatives: Governments and corporations worldwide are committing to net-zero carbon emissions targets, driving the adoption of green ammonia as a sustainable alternative to fossil fuel-based products. The European Union’s Green Deal and the United States’ Inflation Reduction Act are examples of policies incentivizing green ammonia production.

-

Renewable Energy Integration: The declining costs of renewable energy technologies, such as solar and wind power, have made green ammonia production economically viable. Countries with abundant renewable energy resources, such as Australia and Chile, are emerging as key players in the green ammonia market.

-

Energy Storage and Transportation: Green ammonia is gaining traction as a potential energy carrier and storage medium. Its high energy density and ease of transportation make it an attractive option for storing excess renewable energy and exporting it to regions with limited renewable resources.

-

Fertilizer Industry Transformation: The fertilizer industry, which accounts for a significant portion of global ammonia demand, is transitioning towards green ammonia to reduce its carbon footprint. This shift is supported by increasing consumer demand for sustainable agricultural practices.

-

Technological Advancements: Innovations in electrolyzer technology and ammonia synthesis processes are reducing production costs and improving efficiency, further driving market growth.

Opportunities in the green ammonia market are vast, particularly in regions with high renewable energy potential and strong policy support. Emerging markets in Asia-Pacific, the Middle East, and Africa are expected to witness significant growth as they invest in green ammonia production facilities to meet domestic and export demand.

3. Segmentation Analysis

The green ammonia market can be segmented based on application, end-use industry, and geography.

-

By Application:

-

Fertilizers: Green ammonia is a critical component in the production of nitrogen-based fertilizers, which are essential for modern agriculture. The shift towards sustainable farming practices is driving demand for green ammonia in this segment.

-

Energy Storage: Green ammonia is being explored as a medium for storing and transporting renewable energy. Its ability to be easily liquefied and transported makes it an ideal solution for energy storage in remote areas.

-

Transportation Fuel: Ammonia is being considered as a zero-carbon fuel for shipping and other heavy transportation sectors. Its high energy density and compatibility with existing infrastructure make it a promising alternative to traditional fuels.

-

Industrial Feedstock: Green ammonia is used as a feedstock in various industrial processes, including the production of chemicals, plastics, and explosives.

-

-

By End-Use Industry:

-

Agriculture: The largest end-use industry for green ammonia, driven by the need for sustainable fertilizers to support global food production.

-

Energy: The energy sector is increasingly adopting green ammonia for energy storage and as a clean fuel alternative.

-

Chemicals: The chemical industry is utilizing green ammonia as a feedstock for the production of various chemicals, including nitric acid and ammonium nitrate.

-

Transportation: The shipping industry is exploring green ammonia as a zero-emission fuel to meet international decarbonization targets.

-

-

By Geography:

-

North America: The United States and Canada are investing heavily in green ammonia production, supported by government incentives and renewable energy resources.

-

Europe: Germany, the Netherlands, and Norway are leading the way in green ammonia adoption, driven by stringent climate policies and renewable energy targets.

-

Asia-Pacific: Countries like Australia, Japan, and India are emerging as key players in the green ammonia market, leveraging their renewable energy potential and growing demand for sustainable fertilizers.

-

Middle East & Africa: The region is investing in green ammonia projects to diversify its energy exports and reduce carbon emissions.

-

Latin America: Chile and Brazil are exploring green ammonia production to capitalize on their abundant renewable energy resources.

-

More Insights Of Full Report In Details:https://www.maximizemarketresearch.com/market-report/global-green-ammonia-market/115753/

4. Country-Level Analysis

-

United States: The U.S. is a major player in the green ammonia market, driven by the Inflation Reduction Act and significant investments in renewable energy infrastructure. States like Texas and California are leading the way in green ammonia production, supported by their vast wind and solar resources.

-

Germany: Germany is at the forefront of green ammonia adoption in Europe, with several pilot projects underway to integrate green ammonia into its energy and industrial sectors. The country’s commitment to achieving carbon neutrality by 2045 is a key driver of market growth.

-

Australia: Australia is emerging as a global leader in green ammonia production, leveraging its abundant solar and wind resources. The country is investing in large-scale green ammonia projects to meet domestic demand and export to Asia-Pacific markets.

-

Japan: Japan is a key importer of green ammonia, driven by its need to decarbonize its energy and industrial sectors. The country is investing in green ammonia supply chains and collaborating with international partners to secure a stable supply.

-

India: India is focusing on green ammonia to reduce its dependence on imported fertilizers and meet its climate goals. The country is investing in renewable energy infrastructure to support green ammonia production.

5. Competitive Analysis

The green ammonia market is highly competitive, with several key players investing in research, development, and production facilities. Major companies in the market include:

-

Yara International: A leading player in the global fertilizer industry, Yara is investing heavily in green ammonia production to reduce its carbon footprint and meet growing demand for sustainable fertilizers.

-

Siemens Energy: Siemens is developing advanced electrolyzer technology to support green ammonia production and is collaborating with industry partners to scale up production.

-

CF Industries: CF Industries is investing in green ammonia projects in the United States, leveraging its expertise in ammonia production and renewable energy integration.

-

Nel Hydrogen: Nel Hydrogen is a key player in the electrolyzer market, providing technology solutions for green ammonia production.

-

ITM Power: ITM Power is developing innovative electrolyzer systems to support the production of green hydrogen and ammonia.

These companies are focusing on strategic partnerships, technological advancements, and capacity expansion to strengthen their market position and capitalize on the growing demand for green ammonia.

6. Press Release Conclusion

The green ammonia market is on the brink of a transformative era, driven by the global push towards decarbonization and sustainable energy solutions. With a projected CAGR of over 70% from 2023 to 2030, the market is set to reach USD 5.4 billion by the end of the decade. Key growth drivers include government policies supporting renewable energy, technological advancements in electrolyzer and ammonia synthesis processes, and the increasing demand for sustainable fertilizers and fuels.

Countries like the United States, Germany, Australia, and Japan are leading the way in green ammonia adoption, supported by strong policy frameworks and investments in renewable energy infrastructure. The competitive landscape is characterized by strategic collaborations and technological innovations, with major players like Yara International, Siemens Energy, and CF Industries driving market growth.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- Travels