Cross-Border Innovation Drives Global Growth in Tokenized Assets

The global asset tokenization market is witnessing a paradigm shift in the way physical and financial assets are managed, traded, and transferred. As blockchain technology continues to penetrate the financial landscape, tokenized assets are becoming a cornerstone of decentralized finance (DeFi), offering enhanced transparency, improved liquidity, and broader access to investment opportunities.

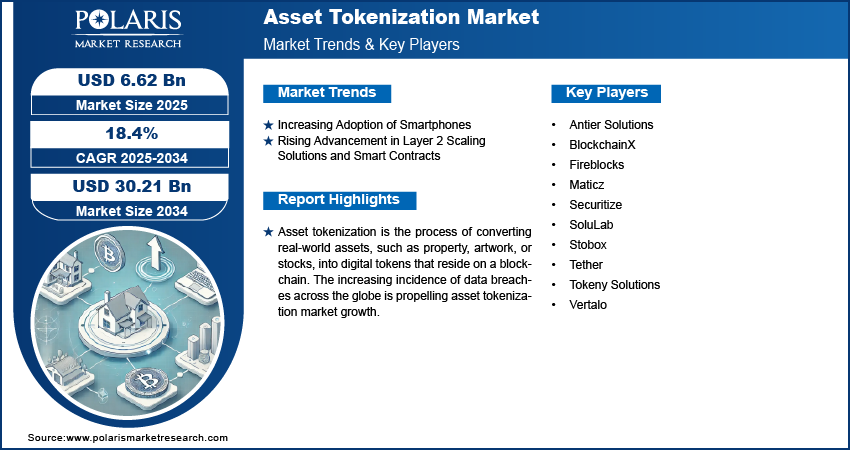

The global asset tokenization market size was valued at USD 5.60 billion in 2024. The market is projected to grow from USD 6.62 billion in 2025 to USD 30.21 billion by 2034, exhibiting a CAGR of 18.4 % during 2025–2034.

Market Overview

Asset tokenization refers to the process of converting ownership rights of real-world or financial assets into digital tokens on a blockchain. These tokenized assets can represent anything from real estate, fine art, and commodities to equities and bonds. The transformation facilitates fractional ownership, reduces transaction costs, and enhances liquidity across traditionally illiquid asset classes.

The market has seen a notable surge in demand for digital securities and programmable ownership structures, especially with the rise of decentralized finance (DeFi) platforms. Asset tokenization is becoming increasingly essential for institutions aiming to modernize their infrastructure while maintaining compliance and improving asset mobility.

Key Market Growth Drivers

1. Integration of Blockchain Technology

The primary engine behind asset tokenization is blockchain technology. The immutable, decentralized, and secure nature of blockchain ensures transparency in ownership, audit trails, and transaction efficiency. Distributed ledger technology also reduces intermediaries, streamlining asset issuance and transfer processes.

2. Rising Demand for Tokenized Assets in Capital Markets

Traditional investment assets like real estate and private equity have long faced liquidity challenges. Tokenization enables fractional ownership, allowing investors to buy, sell, or trade fractions of assets with ease. This shift democratizes access to high-value assets, thereby expanding the investor base and enhancing liquidity in secondary markets.

3. Growth of Smart Contracts and Automation

Smart contracts play a pivotal role in the automation of compliance, dividend distribution, and investor rights management. Their role in enforcing terms and conditions of digital securities without the need for intermediaries has made them integral to scalable tokenization platforms.

4. Regulatory Advancements and Government Support

Countries such as Switzerland, Germany, Singapore, and the UAE have introduced progressive regulations recognizing digital securities and blockchain-based financial instruments. This regulatory clarity is encouraging institutional players to enter the space, ensuring risk mitigation and market legitimacy.

Market Challenges

Despite its growth potential, the asset tokenization market faces several challenges:

- Regulatory Uncertainty in Emerging Markets: While some jurisdictions have taken a clear stance on tokenized assets, others lag behind, creating regulatory ambiguity that deters investment and innovation.

- Scalability and Interoperability Issues: Many tokenization platforms still struggle with performance bottlenecks and lack of interoperability with traditional financial systems and across different blockchains.

- Cybersecurity Concerns: The digital nature of tokenized assets makes them vulnerable to cyberattacks and fraud. Ensuring secure storage, access, and transfer mechanisms is essential for building trust.

- Market Education and Awareness: There remains a gap in understanding among retail and institutional investors regarding the benefits, risks, and mechanisms of asset tokenization.

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐓𝐡𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐂𝐨𝐦𝐩𝐫𝐞𝐡𝐞𝐧𝐬𝐢𝐯𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐇𝐞𝐫𝐞 @ https://www.polarismarketresearch.com/industry-analysis/asset-tokenization-market

Regional Analysis

North America

North America dominates the asset tokenization market, accounting for over 35% of global revenue in 2024. The United States has seen a strong influx of startups and institutional investors focusing on tokenized real estate, equities, and debt instruments. Regulatory bodies like the SEC and FINRA have made strides in recognizing digital securities, boosting investor confidence.

Europe

Europe is the second-largest market, driven by progressive regulatory frameworks such as Germany’s Electronic Securities Act and Switzerland’s DLT Act. The region is a hotspot for pilot projects in tokenized bond issuances and security token offerings (STOs), particularly in financial hubs like Zurich, Frankfurt, and London.

Asia-Pacific

Asia-Pacific is expected to be the fastest-growing region during the forecast period, with a CAGR exceeding 23%. Singapore and Hong Kong are leading innovation, backed by clear regulatory guidance and fintech-friendly ecosystems. Tokenization of real estate and private equity is gaining momentum among high-net-worth individuals and family offices.

Middle East & Africa

The Middle East, particularly the UAE and Saudi Arabia, is emerging as a vibrant market for tokenized assets. Government initiatives to digitize financial ecosystems and attract foreign investment are accelerating blockchain adoption. Dubai’s Virtual Assets Regulatory Authority (VARA) plays a key role in establishing the legal framework for digital securities.

Key Companies in the Asset Tokenization Market

Several companies are leading innovation and adoption in the asset tokenization landscape. These key players are shaping the competitive dynamics through platform development, strategic partnerships, and cross-border collaborations.

1. Polymath

Polymath offers blockchain-based infrastructure for issuing and managing digital securities. Its Polymesh blockchain is purpose-built for regulated assets, ensuring identity, compliance, and confidentiality requirements are met.

2. Securitize

Based in the U.S., Securitize provides a comprehensive platform for compliant issuance and management of tokenized securities. The company partners with large financial institutions and recently expanded into secondary trading through its broker-dealer license.

3. tZERO

A subsidiary of Overstock.com, tZERO is a pioneer in security token trading. The company provides an end-to-end solution for issuing, trading, and managing digital securities on a secure, regulated platform.

4. Tokeny Solutions

Headquartered in Luxembourg, Tokeny offers modular and interoperable infrastructure to tokenize financial instruments. It focuses on enabling compliant onboarding, KYC/AML integration, and investor management for issuers.

5. ConsenSys

While best known for Ethereum development, ConsenSys plays a critical role in enterprise blockchain applications, including tokenization of assets via its Codefi product suite. It provides financial institutions with tools to tokenize bonds, equities, and real estate assets.

Future Outlook

The future of the asset tokenization market looks highly promising as financial institutions increasingly embrace digital transformation. As regulatory landscapes mature and blockchain infrastructure becomes more scalable and interoperable, tokenized assets are set to revolutionize the global financial system.

Analysts predict that by 2035, asset tokenization could encompass up to 10% of global GDP, representing trillions of dollars in real estate, private equity, and debt instruments. The convergence of traditional finance with decentralized platforms may also create new opportunities in asset management, secondary trading, and cross-border settlement.

Conclusion

The asset tokenization market stands at the intersection of innovation, efficiency, and inclusivity. By leveraging blockchain technology, smart contracts, and digital securities, it is reshaping capital markets and paving the way for a more transparent and accessible financial future.

However, achieving full potential requires overcoming regulatory hurdles, ensuring interoperability, and fostering trust among market participants. As technology matures and adoption accelerates, tokenized assets are expected to become a standard part of the global investment ecosystem.

More Trending Latest Reports By Polaris Market Research:

Non-Automotive Rubber Transmission Belts Market

Thermal Insulation Coating Market

Drug Discovery Informatics Market

Emission Monitoring System (EMS) Market

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- Travels