Dog vs. Cat Herbal Supplements: Segment Analysis and Consumer Preferences

As global pet ownership rises and the humanization of animals deepens, the pet herbal supplements market is experiencing unprecedented growth. Consumers across continents are embracing natural pet remedies, organic pet supplements, and holistic pet care practices—ushering in a new era of wellness-driven consumption for companion animals.

Market Overview

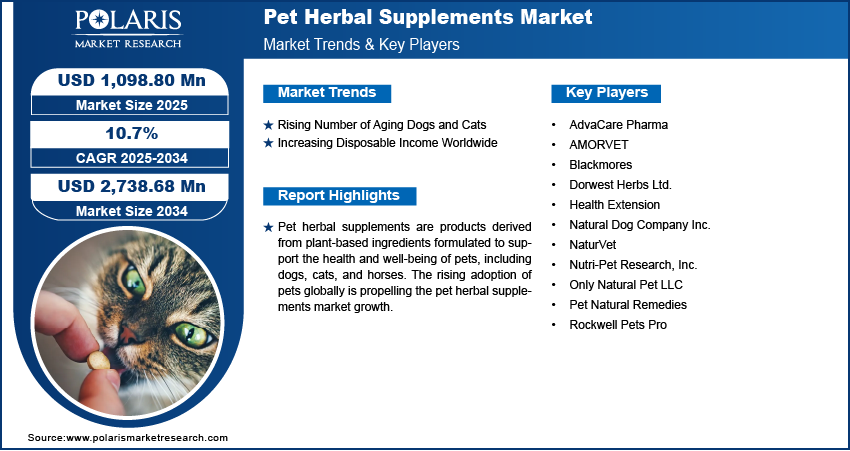

The pet herbal supplements market size was valued at USD 994.57 million in 2024. It is projected to grow from USD 1,098.80 million in 2025 to USD 2,738.68 million by 2034, exhibiting a CAGR of 10.7% during 2025–2034.

Pet owners are becoming more conscious of what they feed and administer to their pets, leading to a growing preference for natural solutions over synthetic pharmaceuticals. Herbal supplements—ranging from anxiety relief to joint support and digestive health—are emerging as essential additions to daily pet wellness routines.

Key formulations in this market often include ingredients like turmeric, chamomile, ginger, milk thistle, and CBD-rich hemp, which provide a range of health benefits without the side effects often associated with conventional medications. These supplements come in various forms including chews, tinctures, powders, and capsules.

Market Trends

- Humanization of Pets Driving Natural Remedies: As pets are increasingly viewed as family members, owners are seeking the same level of care, quality, and transparency in pet wellness products as they would for themselves.

- Rise in Demand for Organic and Chemical-Free Supplements: Organic pet supplements and products with minimal additives are gaining favor, especially among environmentally conscious consumers.

- Focus on Preventive Health: Pet parents are turning to herbal supplements not only to treat but also to prevent issues such as stress, inflammation, and immune dysfunction.

- Botanical Ingredients in Veterinary Care: Integrative veterinary practices are promoting the use of botanical ingredients to support conventional therapies.

- Expansion of E-Commerce Channels: Online platforms are facilitating access to a wider range of niche herbal pet products, expanding consumer awareness and market reach.

Country-Wise Analysis

United States

The U.S. continues to dominate the pet herbal supplements market, driven by widespread pet ownership, rising expenditure on pet wellness, and increasing adoption of holistic pet care. Consumers here show a strong inclination toward natural pet remedies for conditions such as anxiety, arthritis, and digestive disorders. High demand for CBD-infused supplements and products containing turmeric and chamomile is particularly notable. The humanization trend is deeply entrenched, and premiumization is steering growth in organic and non-GMO formulations.

Read More @ https://www.polarismarketresearch.com/industry-analysis/pet-herbal-supplements-market

Canada

In Canada, pet wellness is closely aligned with human health values, leading to rapid adoption of organic pet supplements. Consumers favor products free from artificial preservatives, with transparent labeling and sustainably sourced botanical ingredients. The market is also influenced by a growing population of aging pets, which drives demand for herbal mobility and joint care products. The trend toward locally sourced and eco-conscious packaging is gaining traction.

United Kingdom

The UK market reflects strong support for natural and preventive approaches to pet care. Anxiety-related herbal supplements are particularly in demand due to rising awareness of pet mental health. British pet owners are seeking herbal products that align with vegan and cruelty-free values. Products with British-grown botanicals like valerian and nettle are gaining popularity. Holistic pet care is increasingly being integrated into pet insurance wellness plans.

Germany

Germany's pet herbal supplement market is expanding rapidly, fueled by a cultural preference for homeopathy and herbal medicine. Consumers are drawn to traditional herbal remedies and botanical formulations backed by scientific research. Digestive health, immunity support, and allergy relief are the leading categories. German pet owners show high trust in certified organic and EU-regulated products, with a rising preference for herbal tinctures and capsules over processed chews.

France

In France, the market is being shaped by a growing population of urban pet owners seeking sustainable and natural pet wellness alternatives. French consumers are particularly concerned with product origin and traceability. Pet supplements with French-grown botanicals such as lavender, thyme, and rosemary are seeing increased demand. Aesthetic packaging and holistic branding resonate well with the local consumer base.

Italy

Italian consumers are increasingly embracing natural solutions for pet care, mirroring traditional Mediterranean herbal practices. Olive leaf extract, oregano oil, and artichoke are among the favored botanical ingredients. There is strong demand for herbal supplements that support liver function and digestion. The Italian market is also witnessing a rise in demand for handmade, small-batch herbal pet products sold through boutique pet stores and farmers markets.

China

China is emerging as a dynamic market for pet herbal supplements, buoyed by increasing disposable income and growing awareness of pet wellness. Traditional Chinese Medicine (TCM) principles are being integrated into pet care, with ginseng, goji berries, and reishi mushrooms frequently used in formulations. Urban pet owners in major cities such as Beijing and Shanghai are adopting holistic pet care practices, and online platforms are central to product discovery and purchase.

India

India’s market is growing steadily as urbanization and nuclear families increase pet adoption. Ayurvedic ingredients like ashwagandha, turmeric, and neem are commonly used in pet herbal formulations. Rising incidences of lifestyle-related health issues in pets are pushing consumers toward preventive, natural alternatives. Herbal supplements for skin allergies and immunity support are in high demand, particularly in tropical and humid regions.

Japan

In Japan, the pet herbal supplement market is influenced by cultural reverence for nature and purity. Minimalist packaging and functional benefits dominate consumer expectations. Popular ingredients include green tea extract, shiso leaves, and aloe vera. Supplements aimed at aging pets—particularly those that address mobility and cognitive decline—are performing well. Japanese consumers tend to favor powder and capsule forms with subtle flavoring and high bioavailability.

South Korea

South Korea's booming pet care sector is spilling over into wellness and supplements. Korean pet owners value scientifically backed herbal products with functional benefits. The use of botanical ingredients like ginseng, mugwort, and lotus flower is prevalent. Urban dwellers are seeking stress-relief and calming supplements due to the limited outdoor space for pets in cities like Seoul. Social media and influencer marketing are key drivers in consumer education.

Australia

Australia is witnessing increased demand for eco-conscious and plant-based pet wellness solutions. Native botanicals like eucalyptus, tea tree oil (used cautiously), and Kakadu plum are popular in supplement blends. Consumers prioritize transparency, allergen-free ingredients, and sustainable sourcing. The country’s large dog-owning population favors supplements for joint health and flea resistance, with natural herbal formulations gaining ground on synthetic products.

Brazil

Brazil’s herbal pet supplement market is rapidly developing, especially in urban regions. Traditional plant knowledge, such as the use of maracuja (passionflower) and guarana, is being adapted for pet applications. Brazilian consumers are increasingly turning to holistic approaches for skin conditions, digestive issues, and anxiety relief in pets. Awareness campaigns and growing middle-class disposable income are accelerating demand for natural products.

United Arab Emirates (UAE)

In the UAE, the luxury pet segment is thriving, and premium herbal supplements are becoming popular among affluent pet owners. Climate-driven health issues such as skin dryness and heat-related stress are creating demand for supplements containing aloe vera, flaxseed, and chamomile. Consumers seek halal-certified and locally approved products with international credibility. Retail expansion in premium pet wellness boutiques is also influencing product availability.

Conclusion

The global pet herbal supplements market is on a robust growth trajectory, fueled by a widespread shift toward holistic pet care, sustainable living, and wellness-conscious consumer behavior. As awareness around the benefits of botanical ingredients grows, pet owners are actively seeking natural pet remedies and organic pet supplements tailored to their animals' specific health needs.

Country-specific trends reveal how culture, local plant knowledge, and lifestyle factors influence the types of herbal supplements in demand. Whether it's CBD-based calming chews in the U.S., Ayurvedic formulations in India, or green tea-based immunity boosters in Japan, the market is evolving in diverse yet complementary directions.

More Trending Latest Reports By Polaris Market Research:

Testing, Inspection, and Certification Market

U.S. Steel Merchant and Rebar Market

US Spatial Genomics and Transcriptomics Market

Europe Veterinary Clinical Trials Market

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- الألعاب

- Gardening

- Health

- الرئيسية

- Literature

- Music

- Networking

- أخرى

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- Travels