Menstrual Cup Market by Region: Access, Cultural Factors, and Regulatory Trends

A menstrual cup is a reusable, bell-shaped feminine hygiene product made from medical-grade silicone, rubber, or latex, designed to collect menstrual fluid rather than absorb it like pads or tampons. With the ability to last for up to 10 years, menstrual cups are not only more cost-efficient over time but also dramatically reduce the waste generated by traditional menstrual products.

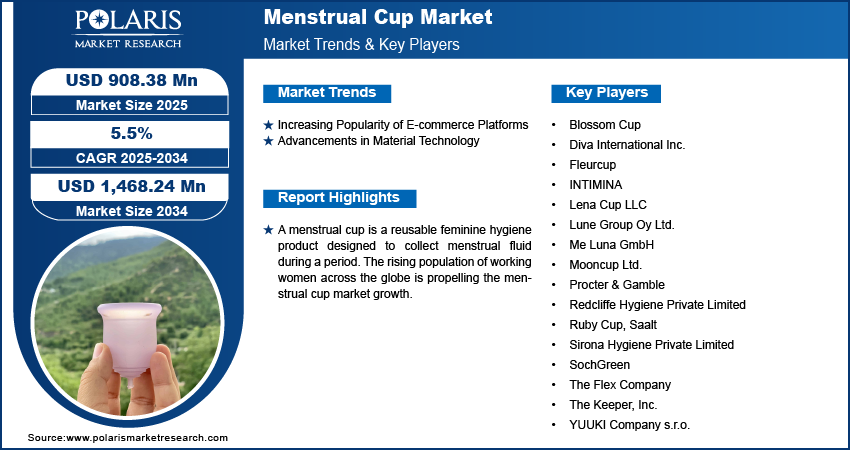

Menstrual cup market size was valued at USD 862.82 million in 2024. The menstrual cup industry is projected to grow from USD 908.38 million in 2025 to USD 1,468.24 million by 2034, exhibiting a CAGR of 5.5% during 2025-2034.

The market's rapid expansion is linked to increasing concerns over plastic waste, affordability of hygiene products, and the health risks associated with disposable sanitary products. Campaigns led by NGOs, health organizations, and social media influencers advocating for sustainable menstrual products have played a critical role in reshaping consumer preferences.

Moreover, growing access to education about menstruation in low- and middle-income countries is eliminating stigmas, encouraging product trial, and boosting long-term adoption of menstrual cups.

Market Segmentation

By Product Type

- Disposable Menstrual Cups

These single-use cups are gaining modest traction, primarily among first-time users and for emergency hygiene kits. Despite their limited market share, they serve niche applications where reusability may be constrained. - Reusable Menstrual Cups

Dominating the market, reusable cups are celebrated for their long-term cost savings, environmental benefits, and convenience. Most brands focus on medical-grade silicone or latex to ensure safety, flexibility, and durability.

By Material

- Silicone

Silicone menstrual cups are the most commonly used, owing to their hypoallergenic properties, flexibility, durability, and comfort. Medical-grade silicone also ensures safety for internal use and longevity. - Rubber

Cups made from rubber are suitable for users not allergic to latex. They are slightly more rigid and appeal to those seeking a firmer option for ease of placement and removal. - Thermoplastic Elastomer (TPE)

TPE is an emerging alternative due to its recyclability and hypoallergenic properties. It is particularly suited for users with latex or silicone sensitivities.

By Distribution Channel

- Online Retail

E-commerce platforms are vital for market growth, offering convenience, anonymity, and extensive product variety. Online availability has widened the market reach, especially among younger, tech-savvy consumers. - Pharmacies and Drugstores

These physical outlets remain important in urban and suburban areas where consumers prefer personal assistance and immediate product access. - Supermarkets and Hypermarkets

Large retail chains are expanding their menstrual hygiene sections to include menstrual cups, often offering multiple brands and promotions to attract new users. - Others (NGOs, Clinics, and Schools)

Distribution through non-traditional channels, especially in developing regions, plays a crucial role in menstrual health education and accessibility.

Regional Analysis

North America

North America is the largest market for menstrual cups, with the United States and Canada leading in terms of both awareness and adoption. High health consciousness, favorable attitudes toward sustainable living, and a well-established e-commerce infrastructure have helped menstrual cups become mainstream in the region.

Government initiatives and non-profit partnerships that offer menstrual cups as part of hygiene programs in schools and public health clinics are further supporting market penetration.

Europe

Europe follows closely, driven by environmental regulations and a strong push toward zero-waste lifestyles. Countries like Germany, the UK, France, and the Nordic nations are among the top adopters. Feminist advocacy and wide-scale awareness campaigns have successfully addressed taboos, leading to the normalization of menstrual cups.

Several EU nations have introduced or reduced VAT on menstrual products, including menstrual cups, enhancing affordability and adoption.

Read More @ https://www.polarismarketresearch.com/industry-analysis/menstrual-cup-market

Asia-Pacific

The Asia-Pacific region presents enormous growth potential. While historically underserved in menstrual hygiene solutions, countries such as India, China, Australia, Japan, and South Korea are seeing rising awareness and a growing urban middle class that is open to sustainable alternatives.

India, in particular, is witnessing a growing acceptance of reusable menstrual products due to government and NGO-led awareness campaigns. However, challenges remain in rural and conservative areas where menstrual taboos persist.

Latin America

Latin America is emerging as a promising market, particularly in countries like Brazil, Argentina, and Mexico. Cultural shifts, increased access to educational resources, and the rise of e-commerce are supporting steady market growth.

Local startups are actively promoting eco-friendly menstrual solutions, and public health initiatives are focusing on menstrual equity, driving product availability in underserved communities.

Middle East & Africa

While still nascent, the Middle East and Africa are expected to witness gradual growth in the coming years. Rising investments in women’s health, NGO-led educational efforts, and increasing social media penetration are encouraging young women to explore alternative menstrual products. However, socio-cultural barriers and limited product availability still hinder widespread adoption.

Key Companies

Several companies are at the forefront of the menstrual cup market, focusing on product innovation, educational outreach, and global expansion strategies to cater to growing demand.

- Diva International Inc.

Known for its flagship DivaCup, the company is one of the pioneers in the menstrual cup industry. It actively promotes menstrual health education and sustainability. - Lunette Menstrual Cup

Based in Finland, Lunette is a leading player in the European market with a strong emphasis on safe materials, transparency, and advocacy for period positivity. - The Keeper Inc.

Among the oldest menstrual cup brands, The Keeper offers latex-based options and emphasizes long-term value and environmental consciousness. - Mooncup Ltd.

A UK-based brand offering medical-grade silicone cups, Mooncup is popular for its ethical manufacturing practices and global outreach. - Saalt LLC

A US-based company recognized for its community-driven approach and modern branding. Saalt invests in initiatives to improve menstrual equity worldwide through product donations and education. - Me Luna GmbH

Known for offering a wide range of sizes, colors, and firmness levels, Me Luna appeals to a diverse audience with customized solutions for different body types and lifestyles.

Other notable brands include Lena Cup, Organicup (now AllMatters), FemmyCycle, and Sirona, each contributing to the market with unique value propositions.

Emerging Trends

- Menstrual Equity Initiatives

Increasing focus on equitable access to menstrual products in schools, prisons, workplaces, and low-income communities is reshaping public policy and market outreach strategies. - Customization and Design Innovation

Companies are offering more personalized options including different sizes, colors, and cup firmness to better suit individual anatomy and lifestyle. - Smart Menstrual Cups

Integration of sensors and app connectivity is a budding area of innovation, enabling users to track menstrual flow, cup placement, and usage time. - Zero-Waste Packaging

Brands are moving toward compostable or recyclable packaging to complement the eco-conscious nature of menstrual cups. - Social Media Advocacy

Influencer-led conversations and peer reviews on platforms like TikTok, Instagram, and YouTube are playing a pivotal role in demystifying menstrual cups and encouraging adoption.

Conclusion

The global menstrual cup market is set for dynamic expansion as consumers increasingly seek sustainable, affordable, and health-conscious alternatives to traditional menstrual hygiene products. With favorable policies, ongoing education, and widespread advocacy, menstrual cups are not only changing how periods are managed—they are revolutionizing the conversation around menstruation itself.

As leading companies continue to innovate and expand into underserved regions, and as menstrual equity becomes a key component of public health and sustainability agendas, the menstrual cup market is on track to become a cornerstone of the feminine hygiene industry in the decade ahead.

More Trending Latest Reports By Polaris Market Research:

Integrated Visual Augmentation System Market

Why is Washed Silica Sand Market, Right Choice for Most Contractors?

Bio-Based Polypropylene in Medical Devices Market

Semantic Knowledge Graphing Market

Point Of Purchase Packaging Market

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- الألعاب

- Gardening

- Health

- الرئيسية

- Literature

- Music

- Networking

- أخرى

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- Travels