Regional Outlook: North America, Europe & Asia-Pacific Drive Growth in EMI Shielding Plastics

The global market for Conductive & EMI Shielding Plastics tailored for 5G and IoT applications is experiencing substantial growth, driven by the rapid rollout of next-generation networks and exponential proliferation of connected devices. With increasing electromagnetic interference (EMI) concerns and a growing need for lightweight, corrosion-resistant solutions, these advanced materials are being adopted as critical components in the development of reliable, high-performance wireless infrastructure and smart electronics.

Market Overview

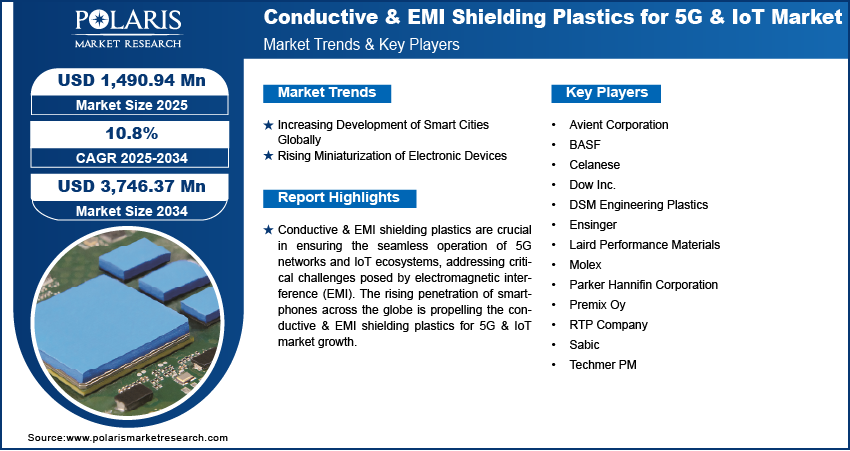

Conductive & EMI shielding plastics for 5G & IoT market size was valued at USD 1,348.29 million in 2024. The conductive & EMI shielding plastics for 5G & IoT industry is projected to grow from USD 1,490.94 million in 2025 to USD 3,746.37 million by 2034, exhibiting a CAGR of 10.8% during 2025-2034.

These plastics, embedded with EMI shielding materials such as carbon fibers, carbon nanotubes, or metal-coated fillers, provide crucial protection for sensitive electronics. Unlike traditional metallic shielding, conductive polymers offer the advantages of reduced weight, improved design flexibility, thermal stability, and corrosion resistance—making them ideal for complex 5G base stations, wearable IoT devices, and autonomous systems.

The market’s momentum is largely attributed to increasing integration of electronics in automotive, healthcare, industrial automation, and smart consumer devices—all of which are sensitive to EMI. As manufacturers seek scalable, cost-effective solutions to ensure signal clarity and device longevity, demand for shielding plastics is on a strong upward trajectory.

Key Market Trends

- Proliferation of 5G Infrastructure Components: The global expansion of 5G networks is creating unprecedented demand for lightweight shielding solutions capable of withstanding high-frequency EMI.

- Miniaturization of Electronic Devices: As IoT devices shrink in size, the risk of electromagnetic interference increases, driving the need for precise, form-fitting conductive polymers for effective shielding.

- Shift Toward Metal Alternatives: Traditional metal-based shields are giving way to plastic-based solutions due to their ease of manufacturing, recyclability, and compatibility with modern injection molding techniques.

- Focus on Thermal and EMI Co-engineering: With rising data rates and higher device density, materials that provide both thermal management and EMI protection are seeing increased adoption.

Country-Wise Market Analysis

United States

The U.S. leads in the development and deployment of 5G technology and connected devices, making it one of the largest markets for EMI shielding materials. The nation’s extensive defense, aerospace, and smart infrastructure sectors require high-performance shielding in mission-critical systems. As 5G becomes integral to urban and industrial connectivity, EMI shielding plastics are increasingly favored for their efficiency and integration ease. Regulatory standards enforced by bodies like the FCC further underscore the importance of maintaining EMI compliance, bolstering market demand.

Canada

Canada’s IoT ecosystem is rapidly expanding, particularly in healthcare monitoring, smart agriculture, and energy management. The country’s growing interest in smart city technologies and remote healthcare delivery has elevated the need for IoT device protection. EMI shielding plastics are gaining popularity in medical-grade devices and ruggedized electronics due to their reliability, non-corrosive properties, and compatibility with sterilization processes. Government initiatives encouraging clean tech and sustainable manufacturing are also spurring the adoption of non-metal shielding materials.

Germany

Germany is a critical European market, driven by the convergence of Industry 4.0 and automotive innovation. The rise of autonomous vehicles, embedded sensors, and V2X communication infrastructure has led to rising demand for 5G infrastructure components with robust EMI shielding. German manufacturers prioritize precision, durability, and lightweight design—all qualities well-matched by conductive polymers. Additionally, the push toward sustainable automotive components has created a fertile environment for recyclable shielding plastics.

France

France is accelerating its digital infrastructure, particularly in transportation and smart grid systems, and this has created a pressing need for reliable EMI solutions. The French market values aesthetic integration and design efficiency, making conductive plastics a preferable option over metals. As government-backed 5G deployment progresses and more urban IoT deployments roll out, demand for EMI shielding materials in consumer electronics and public systems is expected to grow significantly.

United Kingdom

The UK has seen a steady adoption of EMI shielding plastics within sectors such as aerospace, telecommunications, and advanced manufacturing. The nation’s emphasis on developing cyber-secure, EMI-compliant 5G networks has been pivotal in driving market growth. Additionally, investment in smart homes, transport monitoring, and health tech solutions has fueled demand for IoT device protection through compact, effective shielding materials.

China

China is at the forefront of 5G rollout and smart city development. The country’s aggressive expansion of its IoT ecosystem—from surveillance systems to smart manufacturing—makes it a major hub for conductive polymers and shielding plastics. Domestic innovation and policy support from initiatives like “Made in China 2025” are catalyzing demand for lightweight, EMI-resistant plastics, especially in high-volume consumer electronics and telecommunications infrastructure.

India

India is emerging as a significant market driven by a growing digital economy and nationwide 5G deployment plans. The government’s focus on self-reliance in electronics manufacturing and the Digital India initiative are fostering demand for local production of 5G infrastructure components. Additionally, India’s large mobile phone and smart appliance markets present high growth potential for EMI shielding plastics, which offer durability and cost-efficiency in high-temperature, high-interference environments.

Japan

Japan’s highly advanced electronics sector continues to explore next-generation materials for miniaturized consumer and industrial devices. As Japanese companies focus on creating lighter, more compact gadgets, EMI shielding materials that align with precision engineering needs are seeing increased interest. Japan’s automotive industry, with its emphasis on electric vehicles and advanced driver assistance systems (ADAS), is also contributing to the market through stringent shielding requirements.

South Korea

South Korea is home to cutting-edge 5G and IoT innovations, especially in consumer electronics and telecommunications. The nation's leading status in smartphone production and semiconductor development makes it a prime user of conductive polymers. South Korean manufacturers are incorporating EMI shielding plastics to achieve ultra-thin, high-performance devices, particularly as AI-powered wearables and mobile gadgets dominate the consumer market.

Australia

Australia’s market for shielding plastics is growing steadily due to its expanding 5G connectivity and smart utility programs. With wide geographical coverage requirements, the nation emphasizes lightweight, corrosion-resistant solutions for outdoor 5G base stations. EMI shielding plastics provide weather-resilient alternatives that suit Australia’s infrastructure needs. Additionally, emerging tech startups in urban centers are increasingly utilizing these materials for secure IoT deployments in logistics and agriculture.

Brazil

Brazil’s market is shaped by increasing investments in telecommunications and smart energy systems. The country’s geographic diversity and emerging industrial IoT deployments create unique challenges for EMI compliance. As wireless networks expand to support smart agriculture and remote healthcare, the demand for durable, temperature-stable EMI shielding plastics is on the rise. Brazilian manufacturers are also showing interest in locally producing recyclable EMI shielding materials to reduce reliance on imported metals.

South Africa

South Africa’s growing focus on digitization and energy infrastructure is supporting demand for 5G infrastructure components. EMI shielding plastics are becoming increasingly important in the development of ruggedized electronics that can withstand variable environmental conditions. As the country invests in renewable energy grids and smart metering, these plastics offer lightweight, moisture-resistant protection ideal for electronic modules and communication hubs deployed in remote areas.

Conclusion

The global Conductive & EMI Shielding Plastics Market for 5G & IoT is undergoing significant transformation as technology advances call for smarter, lighter, and more resilient shielding solutions. These plastics not only meet the rigorous demands of modern connectivity but also provide scalable solutions for a wide range of industries—including telecommunications, automotive, aerospace, and healthcare.

Across countries, trends reflect a universal need to mitigate electromagnetic interference while keeping pace with the deployment of 5G and IoT technologies. With increasing awareness of environmental impact and the limitations of traditional metal-based solutions, conductive polymers and EMI shielding materials offer a path forward for manufacturers and infrastructure developers alike.

As governments and private sectors work hand in hand to modernize digital infrastructure, the adoption of shielding plastics is set to accelerate—helping to secure the integrity and longevity of the connected world.

More Trending Latest Reports By Polaris Market Research:

Pipeline Pigging Services Market

Drilling Polymers Market: Making Water-Dependent Mud System Steady for High Temperature and Pressure

Diffractive Optical Elements Market

Polyethylene for Drip Irrigation Pipes Market

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- Travels