U.S. Healthcare Facilities Invest in Timers to Improve Endoscope Cleaning Accuracy

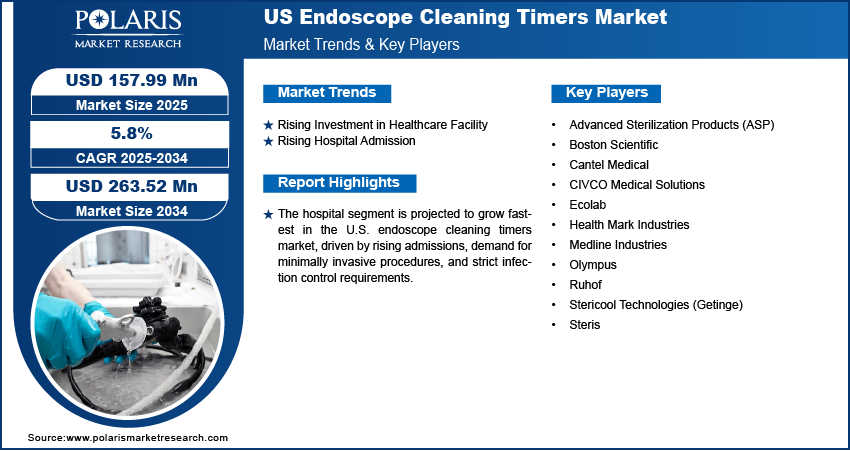

US endoscope cleaning timers market size was valued at USD 149.46 million in 2024. The US endoscope cleaning timers industry is projected to grow from USD 157.99 million in 2025 to USD 263.52 million by 2034, exhibiting a compound annual growth rate (CAGR) of 5.8% during the forecast period.

Endoscope cleaning timers serve as critical tools in tracking and managing time-sensitive steps in the cleaning, disinfection, and drying of endoscopic instruments. These timers ensure that reprocessing staff adhere to infection control standards and guidelines provided by organizations such as the CDC, AAMI, and Joint Commission. By integrating with reprocessing workflow systems, these timers reduce human error, improve documentation accuracy, and support infection risk mitigation efforts.

Market Overview

The U.S. endoscope cleaning timers market is undergoing significant transformation, fueled by rising awareness of the importance of endoscope reprocessing in infection control. Flexible and rigid endoscopy equipment are widely used in minimally invasive procedures, but their complex design and channels make thorough cleaning challenging. To prevent cross-contamination and the transmission of multidrug-resistant organisms (MDROs), healthcare providers are investing in modern timing systems to maintain procedural integrity and regulatory compliance.

A growing number of hospitals are adopting digital and programmable timers as part of their automated reprocessing suites, replacing manual tracking methods that often lead to inconsistencies. These digital solutions are becoming integral to infection prevention strategies and are frequently integrated with electronic health record (EHR) and instrument tracking systems.

Moreover, the pressure to meet Joint Commission requirements and AAMI ST91 guidelines has intensified the demand for reliable cleaning verification mechanisms. Timers now offer real-time alerts, documentation integration, and cloud-based analytics, enabling facilities to monitor staff adherence and optimize their reprocessing efficiency.

The U.S. market is projected to grow at a steady CAGR over the next five years, driven by increased procedural volumes, heightened scrutiny of endoscope-related infections, and technological innovation.

Market Segmentation

The U.S. endoscope cleaning timers market can be segmented based on product type, end-user, and distribution channel:

By Product Type:

- Manual Cleaning Timers: Simple devices used during the pre-cleaning and manual cleaning phases to ensure that soaking and brushing steps meet timing guidelines.

- Digital Programmable Timers: Advanced timers offering programmable settings, alarms, and integration with digital reprocessing systems.

- Multi-Station Timers: Allow simultaneous timing of multiple endoscopes or reprocessing steps, ideal for high-volume reprocessing departments.

By End-User:

- Hospitals: Represent the largest share of the market, due to the high volume of procedures and stringent infection control protocols.

- Ambulatory Surgical Centers (ASCs): An emerging segment showing rapid adoption of digital timing tools to comply with accreditation requirements.

- Specialty Clinics: ENT, urology, and gastroenterology clinics are also investing in standalone cleaning stations with built-in timers for smaller scale operations.

By Distribution Channel:

- Direct Sales: Major hospitals and IDNs often procure timers directly from manufacturers, especially when bundled with reprocessing equipment.

- Distributors and Resellers: Smaller clinics and ASCs rely on authorized medical device distributors for access to timing products.

- Online Retail: Digital platforms are growing as a channel for acquiring compact and standalone timer devices, especially for outpatient facilities.

Regional Analysis:

Northeast U.S.

The Northeast region leads the U.S. market due to its high concentration of academic medical centers, well-funded hospital systems, and proactive infection control programs. Hospitals in New York, Massachusetts, and Pennsylvania are at the forefront of adopting digital programmable timers integrated into their reprocessing workflow to ensure traceability and standardization.

Many healthcare systems in this region are undergoing third-party audits and accreditation reviews, driving the need for more advanced, compliant timing systems. Emphasis on evidence-based cleaning protocols is pushing facilities toward automated reprocessing environments with built-in data monitoring capabilities.

Read More @ https://www.polarismarketresearch.com/industry-analysis/us-endoscope-cleaning-timers-market

Midwest U.S.

States such as Illinois, Ohio, and Michigan are witnessing increased adoption of endoscope cleaning timers in response to regional HAI outbreaks and patient safety initiatives. The demand is particularly high among large urban hospitals and regional healthcare networks implementing centralized sterile processing departments (CSPDs).

The Midwest is also home to several reprocessing training centers, further contributing to regional awareness of proper infection control standards and the role of timing in effective cleaning. Hospitals are retrofitting legacy cleaning rooms with modern timing systems to boost process efficiency and compliance.

South U.S.

The Southern U.S., including states like Texas, Florida, and Georgia, is experiencing rapid growth in outpatient procedures, boosting demand for affordable and scalable timing solutions. Ambulatory Surgical Centers (ASCs) and GI clinics are investing in multi-station timers that support high procedural throughput.

Healthcare providers in this region are embracing lightweight, digital timers that can be deployed flexibly across reprocessing stations. With growing regional investments in healthcare infrastructure, the South is expected to remain a high-growth market for both entry-level and advanced timer products.

West U.S.

California, Washington, and Arizona are driving innovations in infection prevention technologies, making the Western U.S. a vital hub for timer adoption. The presence of leading research hospitals and strong compliance with infection control mandates has created fertile ground for early adoption of integrated digital timer systems.

Healthcare providers in this region are adopting timers with cloud-based reporting features to meet audit demands and enhance transparency in cleaning documentation. Reprocessing staff are trained to adhere to tight procedural timings using automated cues, which significantly reduces the risk of noncompliance.

Key Market Drivers

- Rising Infection Control Awareness: The surge in multidrug-resistant organisms and hospital-acquired infections is placing pressure on healthcare facilities to enhance their disinfection protocols. Timers ensure critical timeframes for brushing, soaking, and disinfecting are met with accuracy.

- Regulatory Compliance: U.S. hospitals must adhere to CMS, AAMI, and Joint Commission guidelines that emphasize documentation of reprocessing times. Timers provide proof of compliance and improve audit readiness.

- Growth in Endoscopy Procedures: With a steady increase in minimally invasive procedures, the volume of endoscopy equipment being reprocessed is on the rise, necessitating more precise workflow management.

- Integration with Digital Systems: Next-generation automated reprocessing solutions offer compatibility with electronic logs and dashboards. Timers are becoming a crucial part of this digital ecosystem, enabling real-time tracking and data-driven insights.

More Trending Latest Reports By Polaris Market Research:

Human Immunodeficiency Virus (HIV) Drugs Market

Advanced Wound Care Management Market

Age-Related Macular Degeneration (AMD) Market

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- Travels